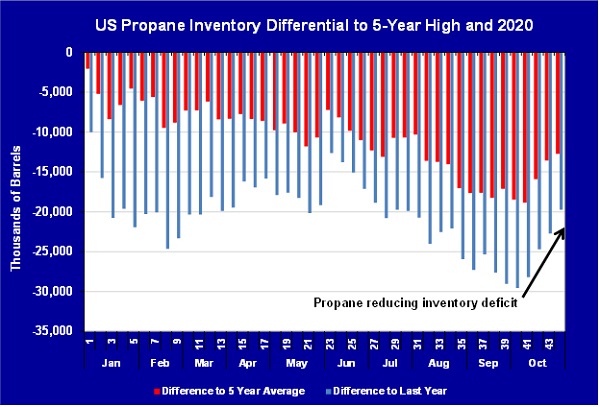

Mild start to heating season shrinks inventory deficit

November 9, 2021 By Mark Rachal

Mark Rachal, director of research and publications for Cost Management Solutions, discusses the propane inventory deficit and the mild start to heating season.

Read More