Last week’s warning signals didn’t pan out

August 31, 2021 By Mark Rachal

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal,…

Read More

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal,…

Read More

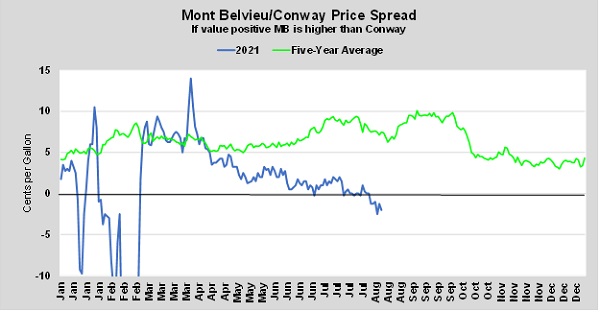

This week, Mark Rachal, director of research and publications, explains why a small shift in propane price strength is worth noting.

Read More

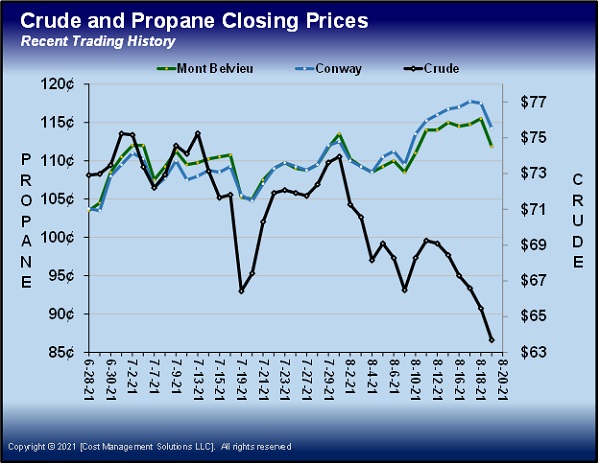

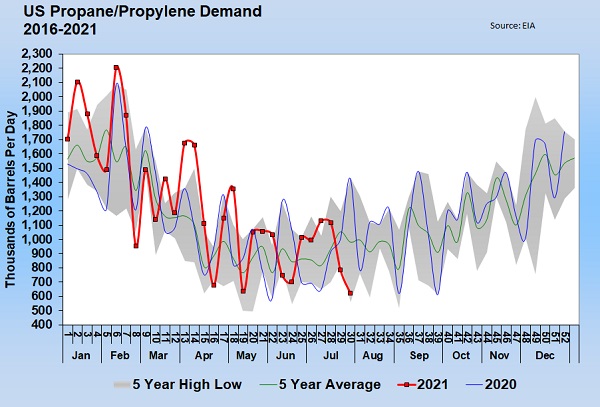

Propane’s price may get to the point of curbing the demand from PDH units, but most analysts don’t think that is happening anytime soon.

Read More

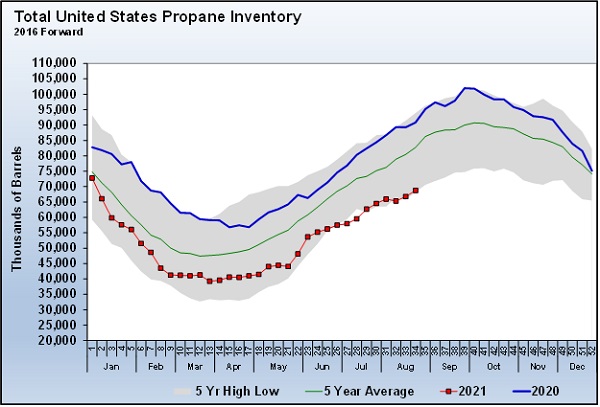

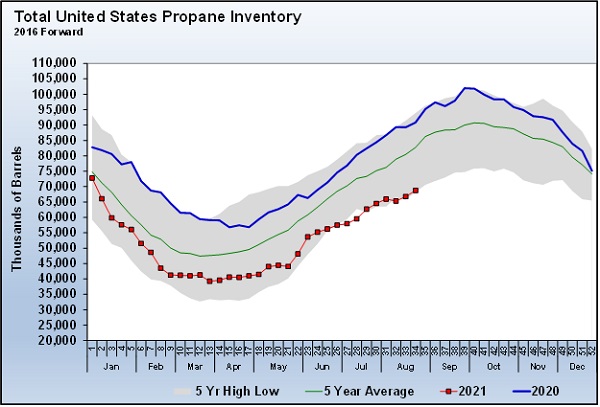

Propane inventory is declining, and the underlying data tells us why. Mark Rachal explains how supply impacts propane inventory levels.

Read More

Mark Rachal, director of research and publications for Cost Management Solutions, addresses the fundamental drivers of propane inventory levels.

Read More

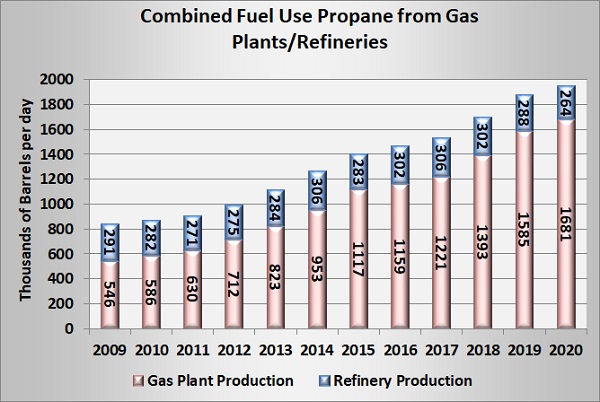

Propane prices are mostly influenced by crude’s price, not natural gas’s price. But the vast majority of propane supply comes from natural gas processing.

Read More

The relatively light build for the week ending July 9 marked the fifth week in a row of inventory building at a below-average pace.

Read More

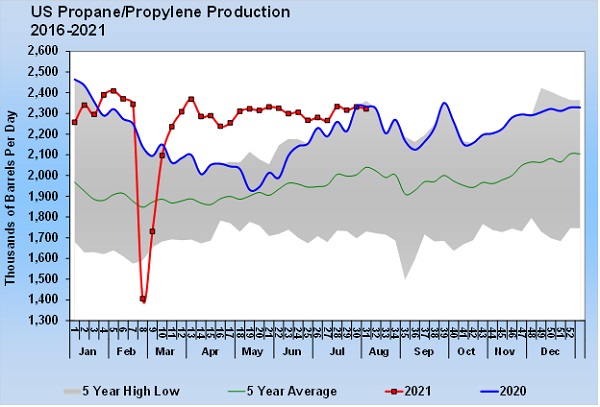

Propane production needs to stabilize or grow to change the pricing environment so propane prices fall again, says Mark Rachal of Cost Management Solutions.

Read More

In a backwardated pricing environment, you may want to consider using financial swaps to lock the price of supply in future months, says Mark Rachal of CMS.

Read More

Not only does EIA data show propane inventory near five-year lows, but prices at Mont Belvieu topped the $1-a-gallon mark for the first time since 2018.

Read More