February brings arctic air and red-hot propane demand

February 16, 2021 By Mark Rachal

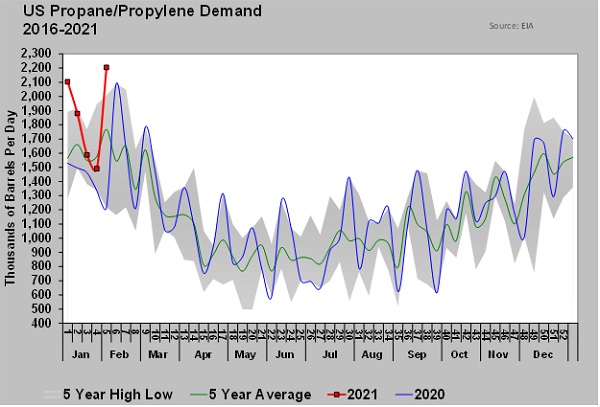

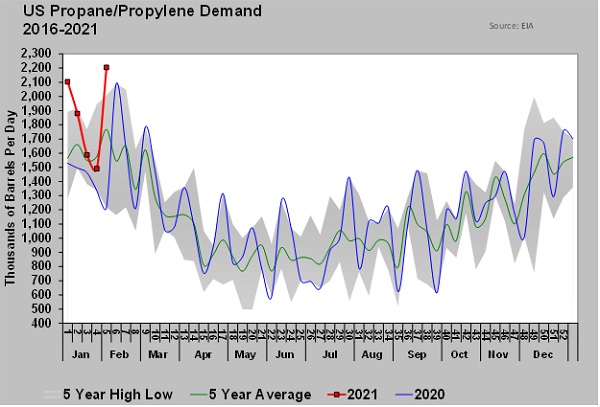

U.S. domestic demand for propane increased a whopping 714,000 barrels per day (bpd) during the fifth week of the year to 2.204 million bpd.

Read More

U.S. domestic demand for propane increased a whopping 714,000 barrels per day (bpd) during the fifth week of the year to 2.204 million bpd.

Read More

If we can pluck good news from propane prices, it would be that next winter’s prices are much lower than the current prices.

Read More

Days of supply measures available inventory to demand. As long as days of supply are trending lower, prices are certainly going to feel upward pressure.

Read More

Since last week’s Trader’s Corner, there was a dramatic change in U.S. propane prices. The change began after the Martin Luther King Jr. Day holiday.

Read More

The quick gains in propane prices like those experienced this past week can have an immediate impact on a retail company’s bottom line.

Read More

As long as export demand remains strong, there is likely to be continued pressure on inventory and thus support for propane prices.

Read More

The retail propane community was once a prominent component of the overall domestic demand picture, but the shale boom created other demand options.

Read More

Hear from Mark Rachal, director of research and publications at Cost Management Solutions, about his expectations for the winter heating season and his advice for retailers.

Read More

Mark Rachal of Cost Management Solutions takes a close look at propane inventory trends ahead of peak demand season.

Read More

Normally, there is a fairly close correlation between the price direction of propane and crude, but sometimes they…

Read More