|

Click here for a free, 10-day trial of The Propane Price Insider!

Call Cost Management Solutions today at 888-441-3338 for more information about how Client Services can enhance your business or drop us an email at info@propanecost.com.

Trader's Corner

This week’s Trader’s Corner looks at the increase in U.S. crude supply and what it is doing to U.S. crude prices compared to Brent crude.

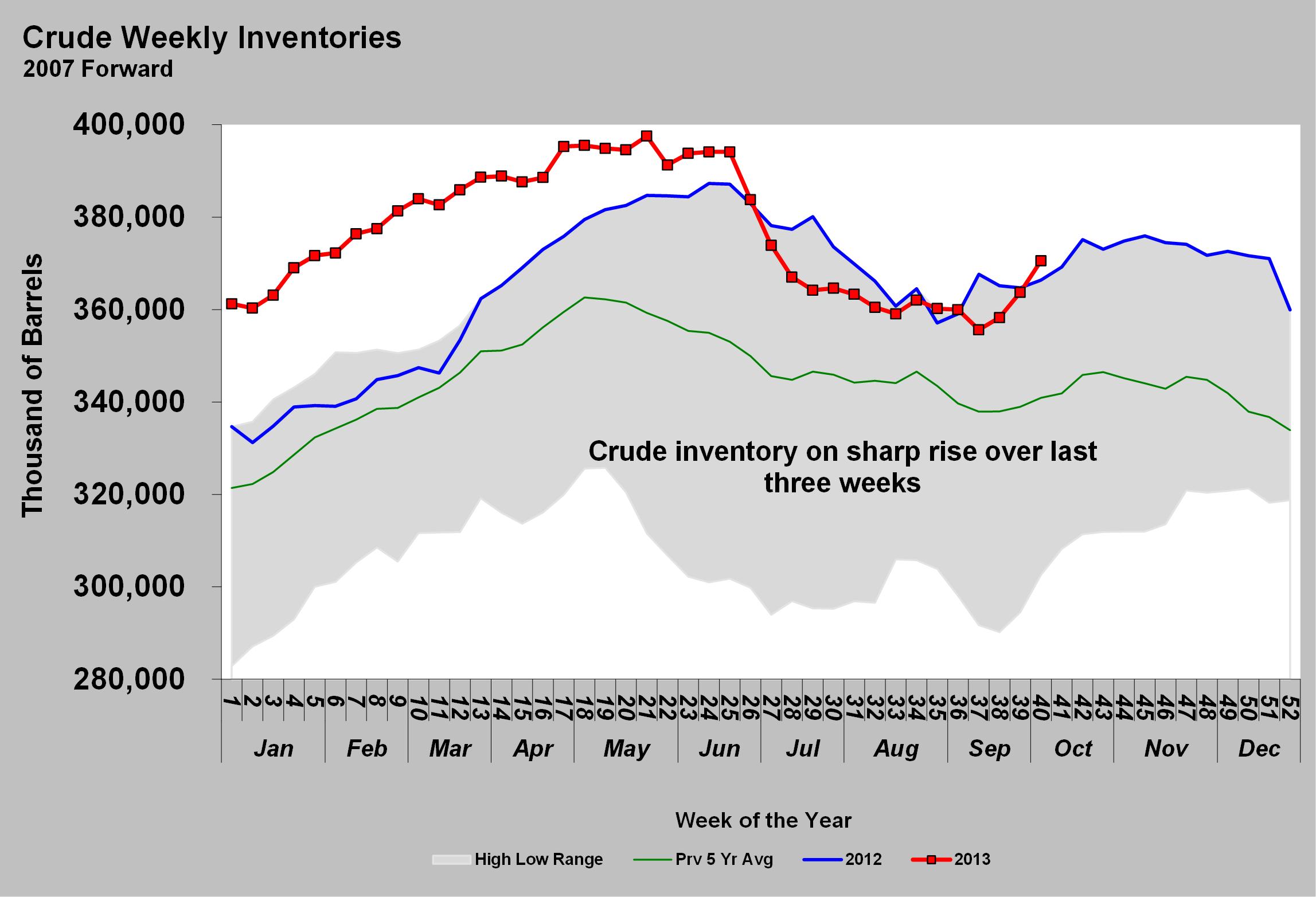

This past week, the U.S. Energy Information Administration (EIA) reported a 6.8-million-barrel build in U.S. crude inventory. The build has U.S. crude inventory setting a new five-year high for week 40 of the year.

Overall U.S. crude inventory is in good shape, which is keeping upward pressure off prices. Markets had been ignoring crude fundamentals because of the threats to supply in the Middle East and with all of the political turmoil in Washington. But with those issues a little less concerning, fundamentals are beginning to play a bigger role in the pricing picture.

From a price perspective, perhaps the change in the inventory trend for crude in Cushing, Okla., is just as influential as the overall U.S. crude inventory picture.

Cushing is where NYMEX trade crude futures settle; it is the Mont Belvieu of the crude world, and inventory there can have a disproportionate effect on crude pricing.

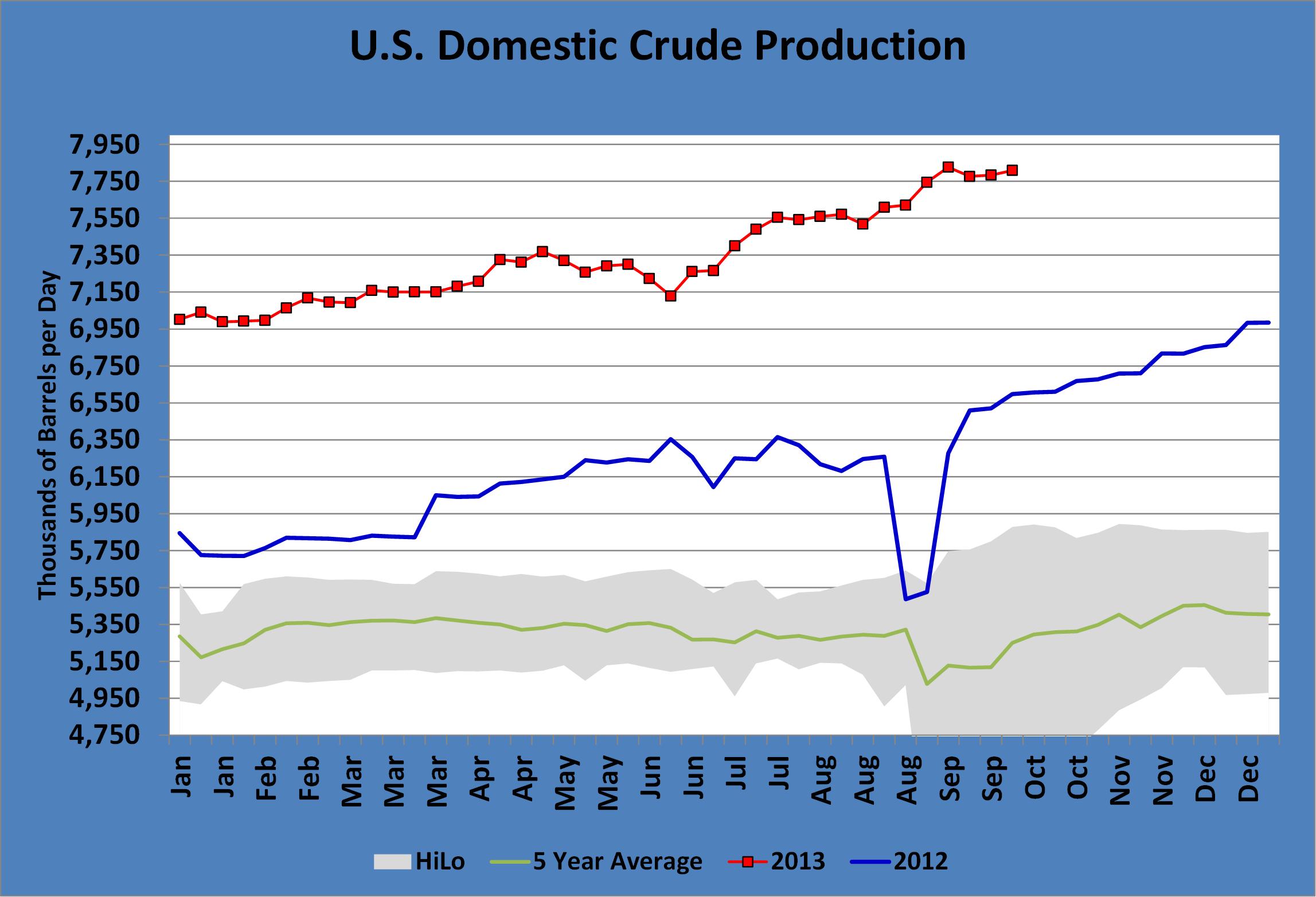

The improvements in the U.S. crude supply picture are coming from increased U.S. oil and gas production. In addition to new crude production, the U.S. market is seeing dramatic increases in natural gas liquids production associated with record natural gas production.

Last week, U.S. crude production was 7.809 million barrels. The trend is definitely up and it is expected to continue. The International Energy Agency believes the United States will overtake Russia as the world’s largest oil liquids producer sometime next year when crude and natural gas liquids are considered.

The new production has caused a seismic shift in the global flow of oil. Just last week, the EIA reported the United States is no longer the world’s top importer of crude, as it has been supplanted by China.

The “revolution” in the U.S. oil and gas industry due to new technologies is having a dramatic, positive impact on the U.S. economy and on national security. Currently it is also having a major impact on the value of the U.S. benchmark crude relative to Brent crude, the global benchmark.

The premium that Brent crude held to West Texas Intermediate (WTI) had almost been reduced to zero in July because Cushing crude inventory was falling so sharply. But the spread is starting to build again as Cushing inventory flattens out, U.S. production continues to increase and Middle East supply issues are more influential on Brent than WTI.

Overall the fundamental picture for U.S. crude prices has become more bearish for prices, leaving the primary supports to come from geopolitical events and the economy.

Call Cost Management Solutions today at 888-441-3338 for more information about how Client Services can enhance your business, or drop us an email at info@propanecost.com.

WEEK IN REVIEW

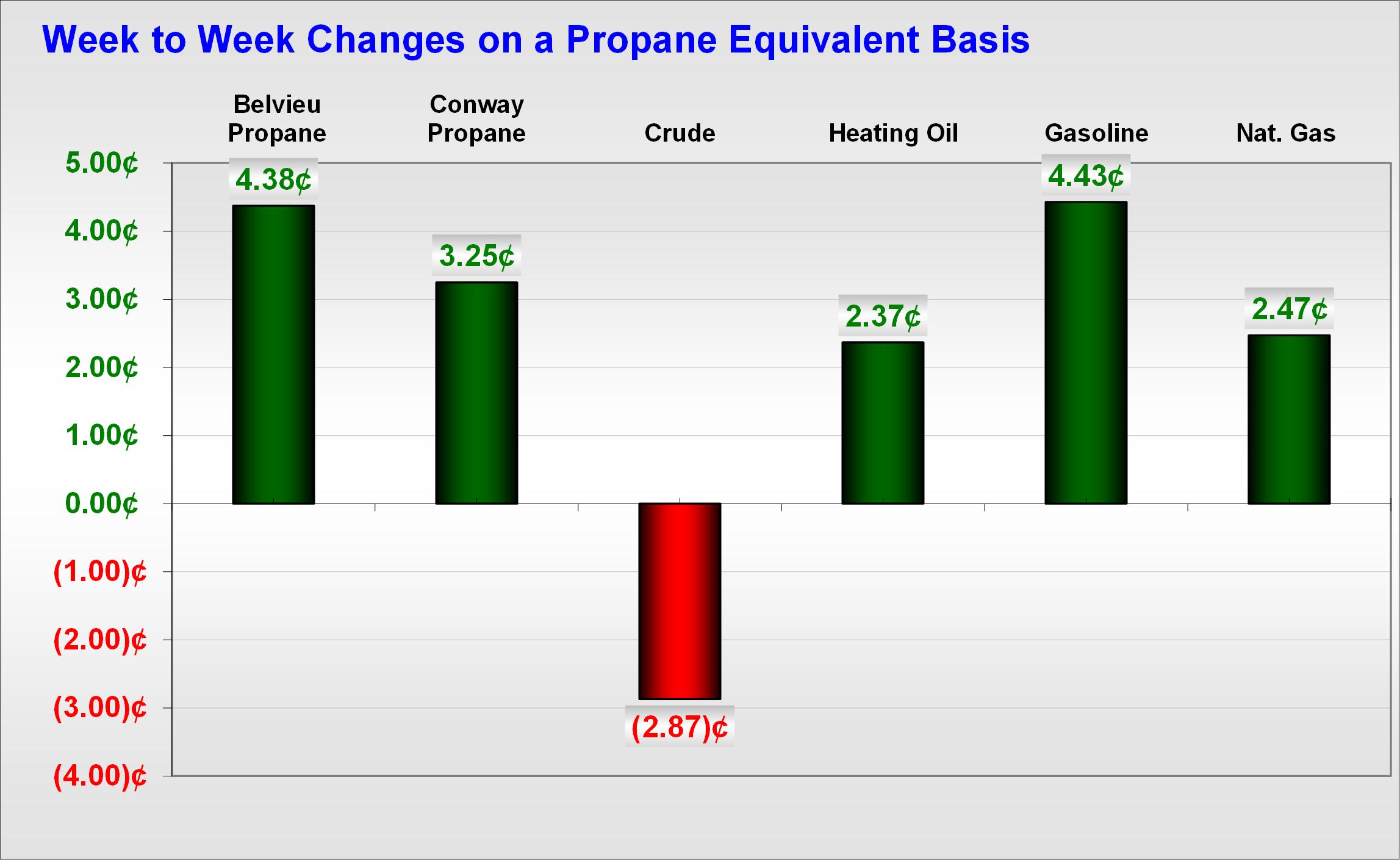

It was a strong week for propane prices, rising against falling crude. Fundamentals were supportive, with the EIA reporting a half-million-barrel draw in propane inventory. We go into the week bullish, given how well propane resisted a fall in crude on Friday.

LAST WEEK'S DAILY HIGHLIGHTS

Monday: Propane fell sharply in early trade, but recovered most of the losses to push Belvieu higher and limit Conway to down a half cent. Lack of progress in the federal government budget/debt-ceiling debate had crude lower.

Tuesday: A surge in buying of local barrels in Mont Belvieu and opportunity buying in crude helped push propane prices higher. Belvieu was strong, with its percentage gain nearly triple that of crude and double what was seen in Conway.

Wednesday: Propane prices initially went higher after the EIA reported a 0.548-million-barrel draw on propane inventory. However, sharply falling crude, due partly to a 6.8-million-barrel build in U.S. crude inventory, eventually became too much for propane prices to overcome, sending both hubs down 0.7 percent.

Thursday: Word of a possible breakthrough in the Washington debt-ceiling impasse caused crude to rally. Propane not only rallied with crude, but it continued to be influenced by last week’s inventory draw. The result was around a 3 percent gain in propane prices.

Friday: Crude fell sharply after reports predicted the world would be well supplied with crude next year. Propane resisted the fall in crude, as propane’s own fundamentals continued to be the key driver of prices. |