|

|

|

|

|

DIGITAL EDITION

|

|

|

|

THIS WEEK'S TOPIC: PROPANE EXPORT

AND

PRODUCTION GROWTH

|

|

Rising propane production exceeds export demand growth

|

|

Propane prices have been falling recently, primarily because crude prices are falling, but propane fundamentals have not been supportive either. New propane production and relatively flat domestic demand means exports need to increase in order to prevent a buildup in propane inventory.

Click to enlarge.

U.S. propane exports are up slightly from where they were last year at this time. Through the third week of November 2017, the Energy Information Administration estimated weekly propane exports were at 850,000 barrels per day (bpd).

This year, exports are at 863,000 bpd, which is not nearly enough growth in exports to offset rising U.S. propane production. Last year, U.S. propane production averaged 1.775 million bpd through the third week of November. This year, production is up 142,000 bpd at 1.916 million bpd.

The imbalance of 129,000 bpd between the growth in production and the growth in exports is the key reason the propane inventory build period lasted longer this year.

Last week, U.S. domestic demand dropped 294,000 bpd to 1.253 million bpd. As of Nov. 16, propane exports jumped from a very low 668,000 bpd to 1.139 million bpd – a 471,000-bpd swing in export rates week over week.

With these swings, domestic demand exceeded exports by just 114,000 bpd. Of course, this was in the midst of fairly cold weather domestically, which shows how impactful export volumes are to balancing supply with demand. There are many factors that impact export demand, making it difficult to predict.

If export rates were to continue at the same rate as last week, U.S. propane inventories would drop quickly. Last week’s 1.984-million-barrel drop in U.S. propane inventory proved that movement. Although, export activity tends to be volatile and a big week like last week is most often followed by lower rates over the following few weeks.

At this point, there has been little indication that growth in export demand will keep up with growth in propane production. Until growth in export demand starts looking comparable to growth in production, propane inventory should hold up well.

However, remember there is a lot of talk that much of the propane inventory is not fractionated and therefore not available to the market. If that is the case, we still could see upward price pressure, even as overall inventories are reported as high.

For now, it appears inventory should hold up well, unless export activity grows along with domestic demand during the winter months.

|

|

|

|

|

|

|

|

|

WHAT IS COST MANAGEMENT SOLUTIONS?

|

|

|

|

|

The Propane Price Insider is an email service that provides:

- Three daily price Flash Wires

- Periodic option quotes

- Wednesday inventory data updates around 11 a.m. ET

-

Evening report with executive summary, weather maps and complete review of energy prices that are based on propane's Btu equivalent

For a free 10-day trial subscription by email, sign up online here or call 888-441-3338.

|

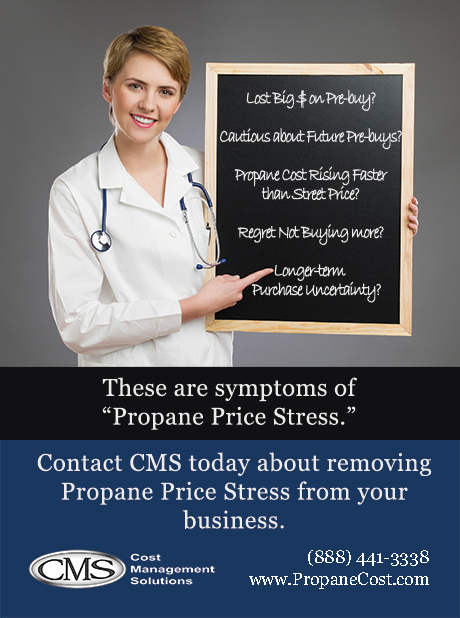

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

Contact us today to see if you can benefit from having the Energy Price Watchdog working for you.

|

Many retailers simply don't have time to analyze the large amounts of data to make an informed purchasing decision.

We offer:

-

Detailed market recommendations on hedge and pre-buy entry points

-

Prompt market execution of hedging strategies

-

Supply cost analysis and recommendation as to effective hedging strategies

-

Large volume consideration when we place your hedges

|

|

|

GOT STORY IDEAS? Email Brian Richesson, Editor in Chief

LOOKING FOR ADVERTISING OPPORTUNITIES? Email Brian Kanaba, Publisher

|

|

|

|