|

|

|

|

|

DIGITAL EDITION

|

|

|

|

THIS WEEK'S TOPIC:

PROPANE EXPORTS

|

|

US propane exports

drop significantly

|

|

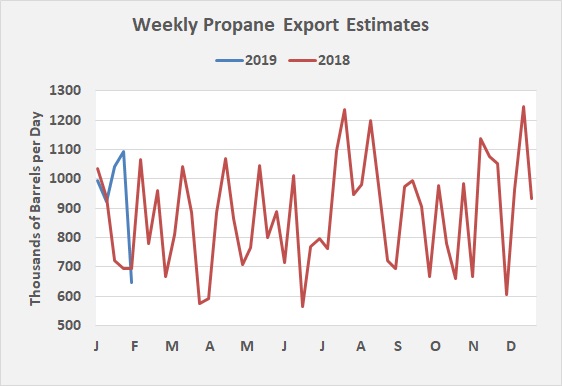

In its Weekly Petroleum Status Report last Wednesday, the Energy Information Administration reported U.S. propane exports dropped to 647,000 barrels per day (bpd) between Jan. 25 and Feb 1, compared to 1.093 million bpd the prior week.

Click to enlarge.

Click to enlarge.

Fog on the Houston Ship Channel may have slowed export activity since the beginning of January. It is also possible exports slipped because of the Chinese New Year, which kept Asian buyers out of the market.

On Jan. 29, industry data estimated exports for January would reach 34.4 million barrels. However, the estimate released Feb. 5 dropped to 31.2 million barrels. The revision suggests shipping delays occurred.

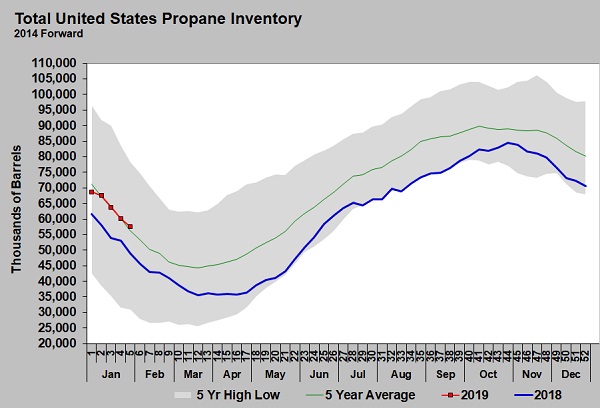

With exports so critical in keeping U.S. supply and demand balanced, the falloff in exports resulted in a below average draw on inventory – despite a 374,000-barrel jump in U.S. propane demand. Inventory fell 2.636 million barrels during the fifth week of this year. Over the past five years, inventory draw during the fifth week of the year averages 3.902 million barrels.

Click to enlarge.

Click to enlarge.

High rates of propane production, high inventory levels and relatively soft growth in propane exports have created a bearish fundamental situation for propane that could continue beyond winter.

|

|

|

|

|

|

|

|

|

WHAT IS COST MANAGEMENT SOLUTIONS?

|

|

|

|

|

The Propane Price Insider is an email service that provides:

- Three daily price Flash Wires

- Periodic option quotes

- Wednesday inventory data updates around 11 a.m. ET

-

Evening report with executive summary, weather maps and complete review of energy prices that are based on propane's Btu equivalent

For a free 10-day trial subscription by email, sign up online here or call 888-441-3338.

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

Contact us today to see if you can benefit from having the Energy Price Watchdog working for you.

|

Many retailers simply don't have time to analyze the large amounts of data to make an informed purchasing decision.

We offer:

-

Detailed market recommendations on hedge and pre-buy entry points

-

Prompt market execution of hedging strategies

-

Supply cost analysis and recommendation as to effective hedging strategies

-

Large volume consideration when we place your hedges

|

|

|

GOT STORY IDEAS? Email Brian Richesson, Editor in Chief

LOOKING FOR ADVERTISING OPPORTUNITIES? Email Brian Kanaba, Publisher

|

|

|

|