|

JUNE 26, 2023 // THIS WEEK'S TOPIC: PROPANE INVENTORY

|

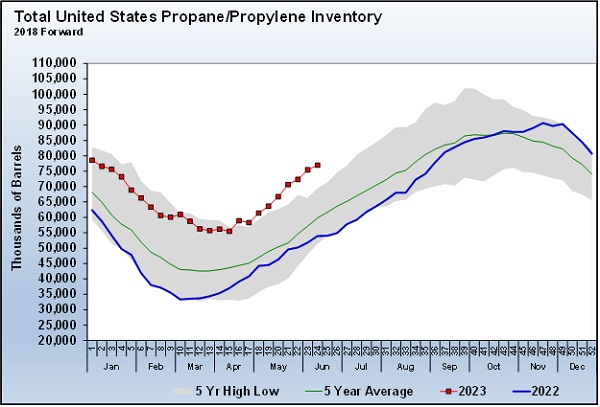

Chart 1: Total United States Propane/Propylene Inventory 2018 Forward. Click to expand.

|

This past week, the U.S. Energy Information Administration (EIA) provided inventory positions for the week ending June 16. The build was 1.491 million barrels, which was below the average build for week 24 of the year and industry expectations. A survey of industry analysts showed an average expectation for a 3-million-barrel build in propane inventory. Over the past five years, inventory had built 2.498 million barrels. Despite the relatively light inventory gain, U.S. propane inventory is easily setting five-year highs for this time of year.

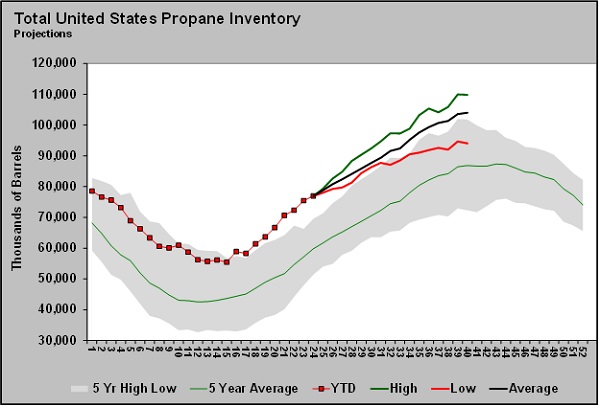

If inventories are this high now, many wonder how high they could be by the start of the winter heating season. We looked at the high, low and average inventory builds from this point in the year to the first week of October to provide some possibilities of where inventory might stand at that point.

|

It turns out that the highest inventory build during this period over the last five years was 2020 and the lowest was 2021, which we will use for the high and low cases. We simply average the inventory changes over the past five years to get the base case.

No matter the case inventory position to start, winter should be very good for buyers and consumers. The base case using the five-year average build in inventories would put levels at 103.985 million barrels. That would be both a five-year high and the highest start-of-winter position on record.

|

Chart 2: Total United States Propane Inventory Projections Click to expand.

|

The higher or more bearish case for prices would put inventory at a blockbuster 109.827 million barrels. Keep in mind that inventories do continue to build beyond the first week of October during some years. In 2005, inventory built all the way to the last week of November. So, there is a scenario where inventory could hit 110 million barrels or higher.

|

The lower build case, based upon what happened in 2021, would put inventory at a comfortable 94.046 million barrels. We are not forecasting any of these scenarios. They are simply examples of where inventories could be to start this winter based on recent history. What we can say, though, is that the market seems to iron out inventory imbalances on a consistent basis. But in this case, it may not be before the start of winter. There would have to be much lighter inventory builds, like the last one from the EIA, to even follow the low case scenario.

Drilling activity for both crude and natural gas points to a slowdown on the supply side at some point. However, there is a considerable lag between decreased drilling and decreased output. The current trend is more toward the base case or high case. A change in that trend would likely require strong demand for propane. For propane, that means exports would have to continue at a very high rate given the weakness in domestic demand that has been prevalent for months. High exports are threatened by a weakening global economy.

|

We should point out that if propane inventory were to start trending more toward the low build case, we could see higher propane prices even though that trend would still have propane inventories in excellent shape to start winter. Propane is at a very low value relative to WTI crude already so an end to the current high inventory build trend would likely be enough to firm up propane prices. If a trend were to develop on the lower case line, we would expect propane to be valued above 40 percent of WTI rather quickly, compared to the 32 percent to 35 percent relative valuations currently.

All charts courtesy of Cost Management Solutions.

|

About Cost Management Solutions

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

|

|

|

|

|

|

|