|

|

|

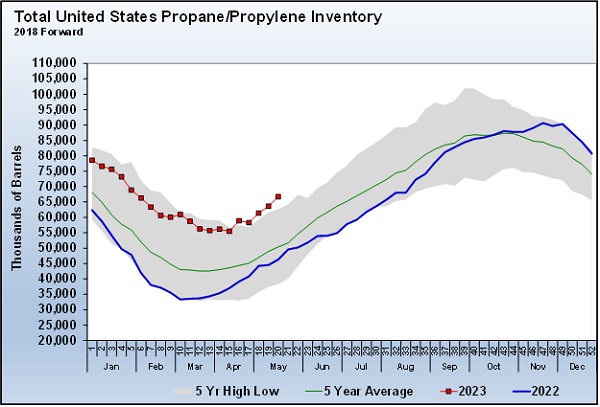

THIS WEEK'S TOPIC: PROPANE PRICES |

|

|

|

Propane retailers fulfill 'dual mandate' to manage price risk |

|

In a recent Trader’s Corner, we mentioned that propane retailers have always had a dual mandate. The first part of the mandate is to protect propane consumers from high prices. The second part of the mandate is to fulfill the first part without taking undue risk that could harm the competitiveness of the retailer and lead to the loss of customers.

We do not believe the first part of the mandate is some type of moral obligation. It is simply good business. One of the first Trader’s Corners we ever wrote was titled “Checkbooks and Sneakers.” When propane consumers are faced with high prices, they only have two responses available. Pay or walk away from their supplier. Walking away could mean going to a competitor or going to another energy source. Another way to walk would be to conserve. |

|

When we say high prices, we are talking about those big spikes in price that really get consumers’ attention and drive them into some type of decision-making process. For the most part, a propane consumer’s world does not revolve around the purchase of propane as some retailers seem to think. A propane consumer is generally happy to take propane for granted and focus on other, more interesting aspects of life. Don’t shock consumers, and most are happy to keep their heads down, write the check and keep the sneakers in the closet. |

|

We are very fortunate that propane generally has been oversupplied for years now, and the exceptionally high spikes in price have been more on the rare side compared to years past. But we shouldn’t become complacent and assume they will never come again. The nature of price spikes is they often seem to come out of nowhere. In our view, a propane retailer should go into any winter with some hedge or price protection that could help mitigate the impact of an unusually high pricing environment. |

|

|

We can’t avoid risk. When we try to avoid one risk, we assume another. Our job is to manage risk, not ignore it. Some retailers are never going to hedge. They are going to buy at market prices, add their markup and move on. They avoid the hedging risk by transferring all of the price risk to the consumer. Most of the time, that works, but there will come a time when making the consumer take all of the risk will result in the sneakers coming out of the closet. |

|

|

Retailers have tools at their disposal to manage the risk of higher prices that the consumer simply doesn’t. That is where the second part of the mandate is in play. We can help the consumer without taking undue risk in the process. The risk is we mismanage the hedging process and have too much of our supply locked in at prices that become uncompetitive in the future. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |

&uuid=(email))