|

|

|

LAST WEEK: MANAGING PRICE RISK |

|

THIS WEEK'S TOPIC: CRUDE PRICES |

|

|

|

Evaluating the state of crude prices |

|

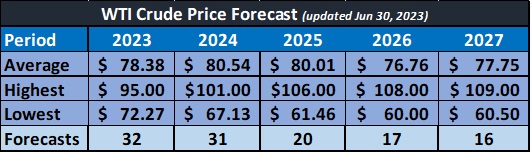

A recent poll of crude analysts shows a decline in expected crude prices this year and next.

For 2023, the average price projected by 32 analysts on June 30 was $78.38. The highest average price for the year was $95 and the lowest $72.27. Crude has averaged $74.69 so far this year, so we are not worried about a $95 average for the year happening. However, our bias is that crude is going to at least maintain its current average or have a higher average by the end of the year. |

|

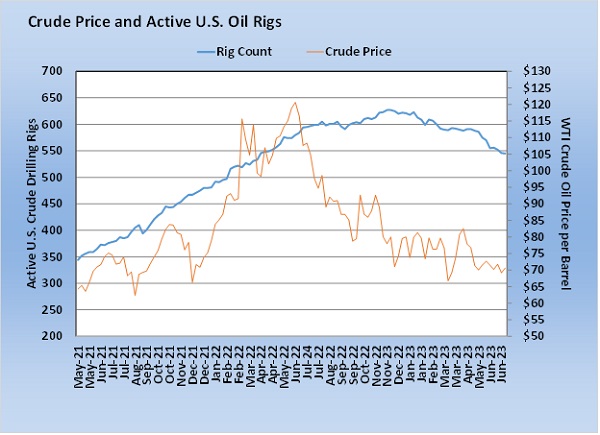

Crude prices have been held in check this year on expectations that weak economic conditions are going to keep crude demand growth down or even reduce it. China’s economy has struggled much more than expected as it opened after maintaining strict COVID-19 related lockdowns far longer than other countries. Economies elsewhere are struggling to get high inflation under control. That struggle includes central banks raising interest rates to slow economic activity. The worries about demand destruction are certainly legitimate. |

|

On the supply side, Russian and Iranian crude continues to move to market despite sanctions. Despite all the political posturing about wanting to punish Russia for invading Ukraine or punishing Iran for its threats to stability in the Middle East, nations are happy to see the crude flowing. Without the crude flowing, inflation would be worse and the negative economic impact on the collective world economy would far outweigh the political benefit of limiting revenue to Russia and Iran. |

|

OPEC+ has responded to demand threats and more supply from Russia and Iran by trying to support prices with production cuts. It currently has production targets that are about 5 million barrels per day (bpd) below its collective benchmark production rate. Kingpin Saudi Arabia voluntarily cut a million bpd more than it was committed to under OPEC agreements during July and has extended that voluntary cut into August. Russia has also announced it will cut 500,000 bpd from its exports in August. Its production will not change; it will simply consume more at home. |

|

|

Also, in August, the U.S. government will flip from transferring crude from the Strategic Petroleum Reserve (SPR) into the commercial market to filling the SPR, which will put it in competition with commercial markets for available supply. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |

&uuid=@{delivery_email}@)