|

|

|

THIS WEEK'S TOPIC: PRODUCTION |

|

|

|

Propane production and where it comes from |

|

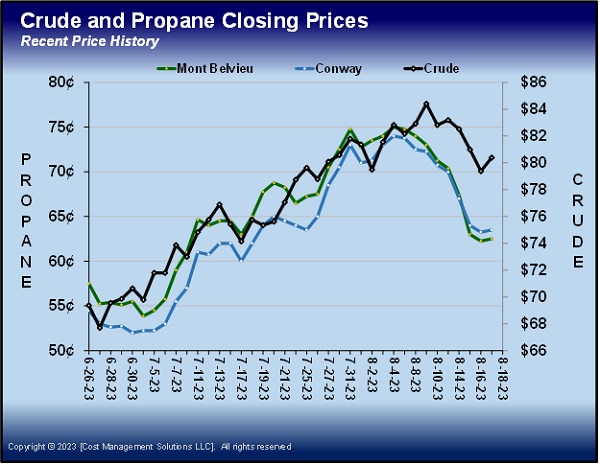

On Aug. 4, when the U.S. Energy Information Administration (EIA) collected data for its Weekly Petroleum Status Report that would be released on Aug. 7, propane had been in a long uptrend, mostly riding the wave of a crude rally but also getting support from lighter-than-normal inventory builds. The rally was showing signs of slowing, but data in that EIA report contributed to ending the propane rally and sending prices into a sharp downtrend. |

|

The data point we refer to is propane production. A few days later, crude prices started falling, adding even more downward pressure on propane prices.

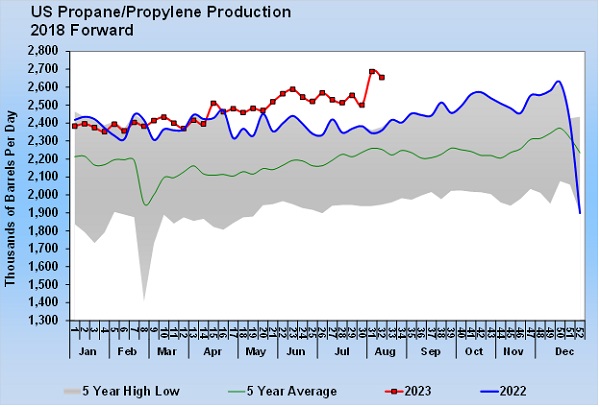

For the week ending Aug. 4, the U.S. produced a record 2.687 million barrels per day (bpd) of propane. It was an enormous increase of 187,000 bpd from the previous week. That kind of production increase could be a game changer for propane fundamentals if sustained. For the week ending Aug. 11, production only dropped off 33,000 bpd. For now, the production increase appears sustainable. |

|

We believe the increase is due to the increased fractionation capacity around Mont Belvieu. When we reported that in our daily Propane Price Insider report, we got some inquiries about propane production. We realized from those discussions the need to review the propane supply chain. It will help clarify why we qualified the statement about propane production by saying it is sustainable for now. |

|

Propane comes from drilling hydrocarbon wells, usually in some remote area of the country. The wells are classified as crude or natural gas depending on whether they produce heavier hydrocarbons (crude) or lighter hydrocarbons (natural gas). An array of hydrocarbons comes from these wells regardless of type.

Near the fields where heavy hydrocarbon wells are drilled, there are separators. In these separators, water settles to the bottom, heavy hydrocarbons are in the middle, and lighter hydrocarbons rise to the top. Each leaves the separator and heads to the next part of the supply chain. The water is generally disposed of in the field, the lighter hydrocarbons head to a natural gas processing plant, and the heavy hydrocarbons go into tanks or pipelines and ultimately end up at a refinery. |

|

Originally, refineries were built all over the country so that, once the crude was refined, the refined fuels would be near a market that needed them. Crude was shipped from production areas to refineries located in demand areas. However, people don’t want refineries near them, and tougher regulations have seen refining capacity become concentrated in areas well away from the refined fuels demand and closer to where the crude is produced. Refined fuels from these centralized refining areas must be shipped via pipeline to areas of demand. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |