|

|

|

THIS WEEK'S TOPIC: PROPANE DEMAND |

|

|

|

The latest factors impacting propane demand |

|

We read that China’s propane dehydrogenation (PDH) plants only ran at 75.6 percent in August and are expected to rise to 80.7 percent in September. That is still a low rate. PDH plants turn propane into propylene. The propylene is then used to make plastics. Because of weak economic conditions resulting in lower demand for plastics, propylene prices have not risen as fast as propane prices this summer. The resulting squeeze in propylene margin is resulting in lower PDH capacity utilization. There are many new PDH plants scheduled to come online over the next few months. Their startup could be delayed if economics do not improve. |

|

PDH plants are huge consumers of propane, and in many ways their current low utilization rate is concerning. If the demand for propylene picks up and PDH plant margins improve, not only could the utilization rate of existing plants increase, the new plants would certainly come online as well. If one or both things occur, we could see a significant rise in propane exports. |

|

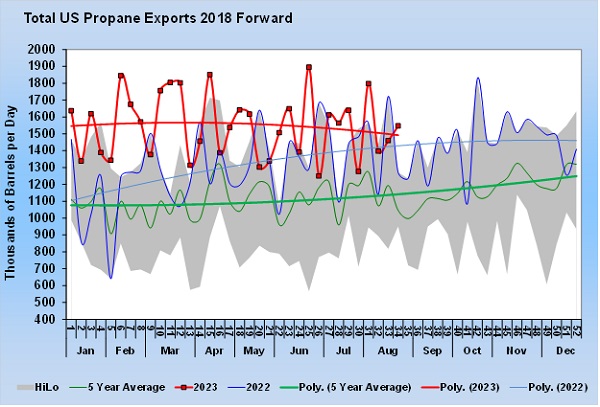

Propane exports started the year very strong but have been tapering off recently. For the year, exports have averaged 247,000 barrels per day (bpd) more than in 2022. However, since the beginning of July, the difference has only been 128,000 bpd, and the current trajectory will put this year on par with last year very soon.

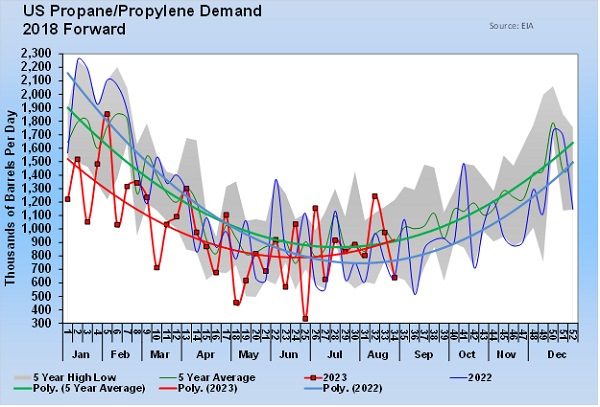

The slowing of export demand has been somewhat offset by an improvement in U.S. domestic demand. |

|

Domestic demand for propane was well down at the start of the year and has averaged 190,000 bpd less than 2022. However, since July, domestic propane demand has averaged 110,000 bpd more than it did during the same period last year.

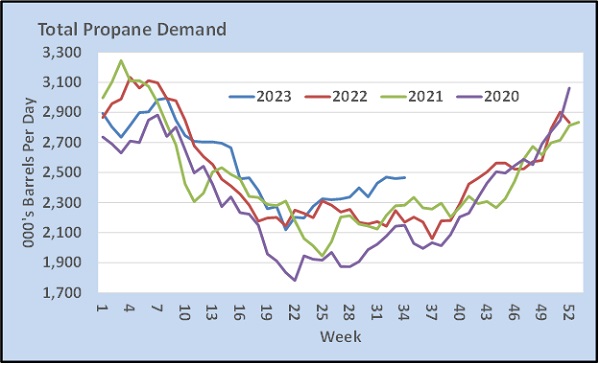

Chart 3 uses the four-week average of total demand (domestic and exports) to take some of the weekly volatility out of the numbers and compares the current demand to the previous three years. Current total demand is well above the previous three years. |

|

Strong propane production has offset the strong demand. U.S. propane production hit a new all-time high three weeks ago. Consequently, propane inventories are setting five-year highs for this time of year, and we all feel very comfortable with the propane supply situation for good reason. All indications are we will have plenty of propane this winter for both domestic and export demand. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |