|

|

|

THIS WEEK’S TOPIC: CRUDE |

|

|

|

Revisiting the state of crude prices |

|

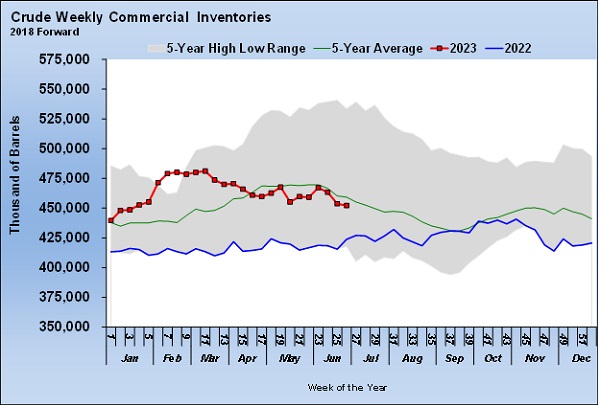

Through the month of July, we wrote a four-part series on the state of crude. In the first part of that series, we included Chart 1 (below).

Then we wrote the following:

“Chart [1] shows U.S. crude inventory. The surplus that was present at the beginning of the year, that was helped by the massive releases from the Strategic Petroleum Reserve (SPR), is eroding away. Inventory started coming down once those releases went away. The resumption of smaller releases since May has not prevented inventory from trending lower. U.S. demand for petroleum products is stronger at this point in the year than it was at the beginning. Refinery capacity is up, so the ability to chew up more crude is present. As we pointed out above, the pressure on inventories could accelerate starting in August. |

|

“In our view, the massive release from the SPR provided a false sense of security concerning crude supply. One must be concerned that, without those releases, the inventory trend will continue toward last year’s line. In July of last year, crude prices were at $100 per barrel. We are hopeful we will not get anywhere near that price this year. However, you can see from all we have discussed above why we believe that crude’s price is more likely to increase from where it is now than decrease.” |

|

When we wrote that article on July 10, WTI crude closed that day at $73.86. As we write today, WTI crude just traded for $87.45 per barrel.

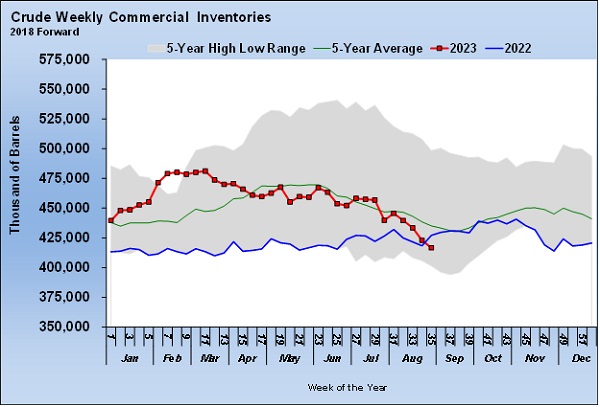

Chart 2 is where crude inventories stood when the U.S. Energy Information Administration collected data for the week ending Sept. 1. |

|

WTI crude has indeed broken below last year’s level and remains in a sharp downtrend. Again, when we wrote that article on July 10, Mont Belvieu ETR propane closed at 59 cents per gallon.

We closed that article that day with this statement:

“Remember, the last two times propane was valued where it is currently, crude was trading at $45 per barrel. If our prediction that crude will remain above $70 going forward holds up, the pressure to improve propane’s value relative to crude will be acute. That means a little improvement in propane’s fundamental conditions likely will have an oversized impact on its pricing. A resumption of the above-average propane inventory build would prevent that from happening, but more upside price risk is currently present than we had been seeing.” |

|

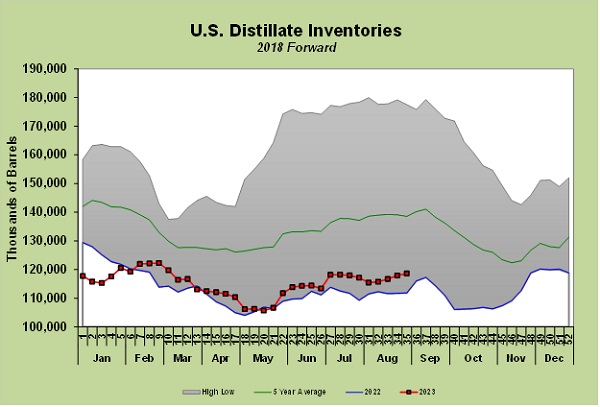

At close on Sept. 7, Mont Belvieu ETR propane traded at 74.5 cents per gallon. Crude has increased $13.01 per barrel, 18 percent since that July article was written, while propane’s price is up 15.5 cents per gallon, a 26 percent increase. Propane’s inventory position is currently setting five-year highs for this time of year, while crude’s inventory is rapidly heading toward five-year lows. Yet propane has outpaced crude higher. Even though propane inventories are high, the rate of the builds in inventories has slowed from where they were coming out of last winter. That slowing has been just enough to cause the gain in propane’s prices to be greater than the gains in crude. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |