|

|

|

THIS WEEK'S TOPIC: DEMAND |

|

|

|

Potentially weak winter demand |

|

Those that read Trader’s Corner regularly know that we expected propane prices to rebound from lows earlier in the year. As we pointed out last week, that has occurred. But we now think the runway for higher propane prices could be getting shorter.

When we think of the direction propane prices might trend, we must weigh influences from two separate but related arenas. The first is what is going on pricing wise in the overall energy complex, most specifically with crude. The second is what is specifically going on with propane fundamentals. Fundamentals being all those factors that affect propane supply and demand. |

|

Imagine approaching a sports complex that has three football fields, but for our purposes we will call it the energy complex. For our analogy the football fields represent where the propane pricing game will be played. Which field we will play the propane pricing game on during the winter of 2023-24 will be determined by the price of crude. One field is the low-price field, one is the normal-price field, and the other is the high-price field. Over the last 10 years, WTI crude has averaged $67 per barrel. It has had a crazy range between a low of minus $37.63 and a high of $123.70. The minus $37.63 was on a wild day during the pandemic when demand was crashing because of shutdowns and an extremely overbought situation had developed. Those long crude were literally paying counterparties to take positions off their hands to close. |

|

Using the average-per-barrel price, we could say a normal range for crude might be $57 to $77 per barrel. When prices are in that range, the propane price game will be played in the middle or normal pricing field at our complex. Below $57, the venue will be the low propane pricing field, and above $77 it will be the high propane pricing field. |

|

The current price of crude dictates the game will be played on the high-price field. The venue could change, but for now, traders are expecting tight crude supplies for the next six to nine months, which will take us through winter. It will take something significant to move the game over to the normal-price field. Something like the collapse of the global economy might result in a venue change. For now, though, the game is being played on the high-price field, and we must be prepared to select a seat in that stadium. |

|

|

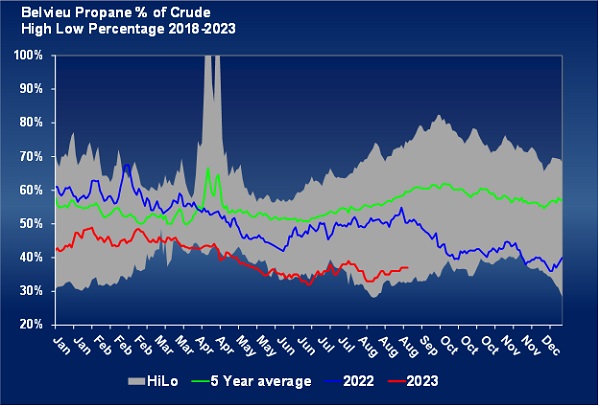

Once we are comfortably seated in the correct stadium at the energy complex, the location of the pricing action on the field will be determined by propane’s fundamentals. Over the last 10 years, propane’s value has averaged 50 percent of the value of WTI crude. When the market sees propane and crude fundamentals about equal, propane’s value relative to crude would be around 50 percent. When propane fundamentals are less price supportive than crude’s – for example, propane supply is exceeding demand – then propane will be valued at less than 50 percent of WTI. For a visual, let’s say that is the left side of our pricing field. When propane fundamentals are more price supportive than crude’s – for example its demand is greater than its supply – prices will move toward the right side of the field. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |