|

|

|

THIS WEEK'S TOPIC: CRUDE |

|

|

|

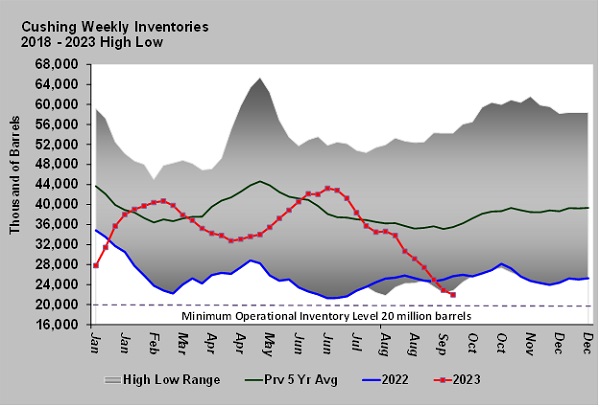

Cushing trading hub for crude becomes central focus |

|

After falling into a downtrend from Sept. 19-26, WTI crude’s price suddenly surged Sept. 27. On that day, WTI crude gained $3.29 per barrel to close at $93.68. Prices spiked again the next morning, reaching $95.03 before tumbling to a $91.39 close.

The sudden bullishness in crude came from a seemingly out-of-nowhere focus on Cushing, Oklahoma, crude inventories. Cushing is the major crude trading hub in the United States. It is where crude futures contracts are settled. Therefore, what goes on at Cushing tends to have an oversized impact on the market. |

|

Cushing has 98 million barrels of storage capacity. It is also a hub for imported crude from Canada and U.S. production fields. It has many outgoing pipelines that provide crude to refineries across the Midwest and South.

It seemed that on Sept. 23 the market suddenly became aware that crude inventories at Cushing were seriously low. Out of nowhere, the news wires were filled with warnings that Cushing inventories were reaching their minimum operational level at 20 million barrels. |

|

Chart 1 shows Cushing inventory is setting a new five-year low for this point in the year. Inventories were low most of last year and even approached the minimum level in June 2022. During that month, WTI peaked at $123.68 per barrel on June 14, 2022. Prices began to fall after that date, hitting $76.25 on Sept. 26, 2022. The drop in price came as inventory levels pulled away from the minimum operational inventory level. |

|

Crude has fallen below the 20-million-barrel mark before. The most recent case was in 2014. Crude prices were around $107 per barrel during that time. The operational requirements may not have been as high back then. One thing is for sure: These low Cushing inventory events have generally resulted in high crude prices. |

|

|

Cushing inventory was at 43.244 million barrels just 13 weeks ago. It has averaged a draw of 1.637 million barrels per week during that 13-week stretch. Inventory is now 1.958 million barrels above the minimum. That means Cushing could be out of deliverable crude in a little over a week. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |