|

|

|

THIS WEEK'S TOPIC: INVENTORY |

|

|

|

Propane inventory starts heating season at record high |

|

In a Trader’s Corner readers would have received on June 26, we wrote about the Energy Information Administration’s (EIA) report for inventory positions as of June 16. In that Trader’s Corner, we showed a forecast of where propane inventories could be at the start of winter. Throughout the industry, the beginning of October marks the beginning of the heating season. Propane inventories can continue to build beyond the start of October, but we generally all want to know where inventories will be to start winter. Providing some outlook on where inventories might be to start winter was the purpose of that June 26 Trader’s Corner. |

|

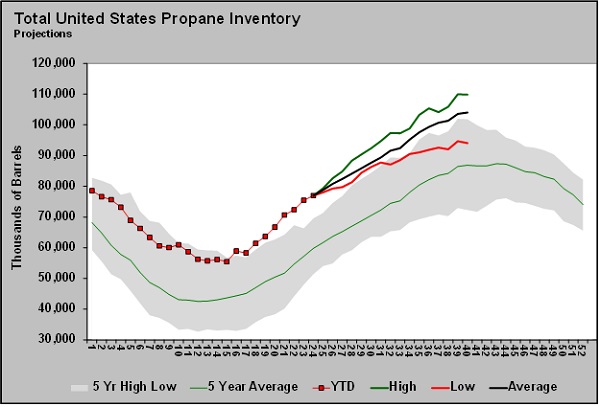

In the article, we provided three scenarios using history as our guide. One scenario used the highest inventory build from that point in the year to the start of winter, one the lowest build and one the average build during that period.

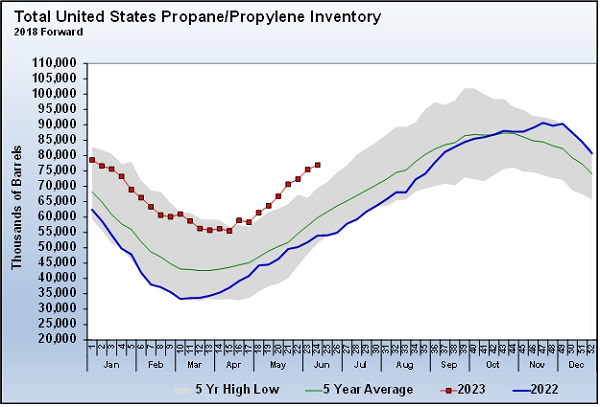

Chart 1 shows where propane inventories were on June 16 when the EIA had last captured inventory positions. To that, we added the three forecasts. |

|

Here are some comments we made about the scenarios:

No matter the case inventory position to start, winter should be very good for buyers and consumers. The base case using the five-year average build in inventories would put levels at 103.985 million barrels. That would be both a five-year high and the highest start-of-winter position on record. |

|

The higher or more bearish case for prices would put inventory at a blockbuster 109.827 million barrels. Keep in mind that inventories do continue to build beyond the first week of October during some years. In 2005, inventory built all the way to the last week of November. So, there is a scenario where inventory could hit 110 million barrels or higher.

The lower build case, based upon what happened in 2021, would put inventory at a comfortable 94.046 million barrels. We are not forecasting any of these scenarios. They are simply examples of where inventories could be to start this winter based on recent history. What we can say, though, is that the market seems to iron out inventory imbalances on a consistent basis. But in this case, it may not be before the start of winter. There would have to be much lighter inventory builds, like the last one from the EIA, to even follow the low case scenario. |

|

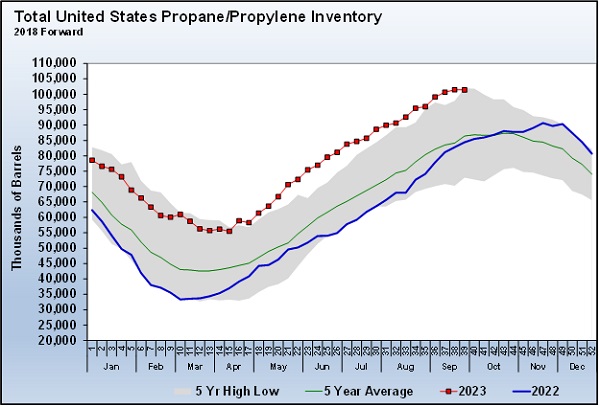

As it turns out, the base case scenario was the most accurate.

Chart 3 shows the latest from the EIA based on data that was collected Sept. 29. Inventory stood at 101.408 million barrels. That was 2.577 million barrels below where the base case had projected inventories. Had inventories built at the five-year average of 2.256 million barrels for week 39 of the year, instead of the surprise 25,000-barrel draw reported, the current inventory position would almost be exactly equal to the base case projection. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |