|

|

|

THIS WEEK'S TOPIC: PROPANE VALUE |

|

|

|

Propane is a cheap Btu |

|

Before the development of shale fields, U.S. crude and natural gas production was falling. U.S. crude production fell to below 5 million barrels per day. Since propane comes from crude and natural gas, there was not enough propane to meet domestic demand. The U.S. was a net importer of propane. As a result, propane held a higher value relative to WTI crude than it does today. On average, propane ran about 70 percent of the value of crude. |

|

After the shale production revolution, U.S. propane supply began to exceed domestic demand, turning the U.S. into a net exporter of propane. Consequently, propane’s value relative to crude began to fall consistently below its previous 70 percent relative valuation benchmark.

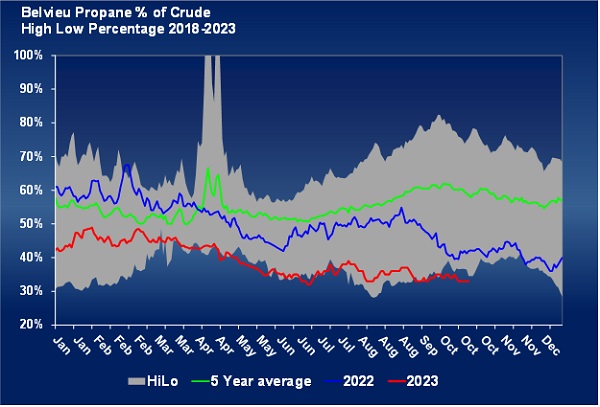

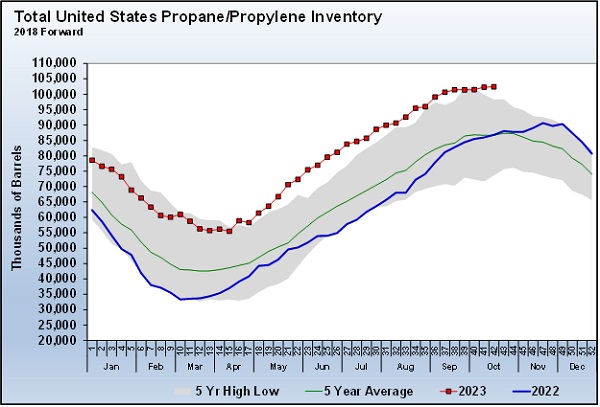

Propane’s average value to crude has been 50 percent in the past 10 years, reflecting the increased abundance of propane. Currently, propane is well below the 10-year average at 33 percent. It is unusual for propane to be valued this low relative to crude during this time of year. In fact, propane is setting new lows each week for this time of year, but it is still above its all-time low of 24 percent set in 2015. That also happens to be the year propane set its all-time highest inventory level of 102.804 million barrels. Currently, propane inventories are less than 500,000 barrels below that record with potential to increase more. |

|

Chart 1 plots propane’s value as a percentage of crude’s value. The five-year average line shows the tendency for propane’s value to increase relative to crude in the lead-up to winter. Propane was following that pattern last year until a weak winter and consumers stressed by inflation caused propane prices to tumble. Propane’s relative value has been well below average since then, and the pre-winter uptick ended this year much more quickly than even last year. |

|

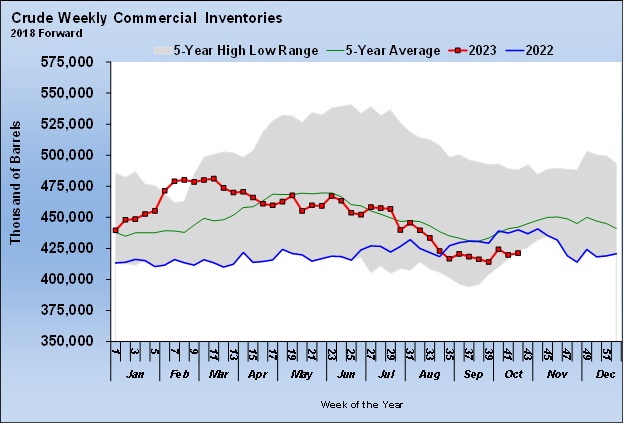

Propane’s weak relative value to WTI crude is a combination of unsupportive fundamentals for propane and supportive fundamentals for crude as the inventory Charts 2 and 3 will show. |

|

Propane’s inventory is setting five-year highs, while crude’s inventories are setting five-year lows for this period during the year. If propane’s fundamentals became more supportive, its relative value to crude would improve, and its nominal value would go up as well. If crude’s fundamentals improve (get less price supportive), crude prices could be driven lower and cause propane’s relative value to crude to increase.

But that could happen without an increase in propane’s nominal value. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |