|

|

|

THIS WEEK'S TOPIC: CRUDE PRICES |

|

|

|

Weaker crude puts propane into counter-seasonal pricing trend |

|

Leading up to the fall, there were plenty of forecasts for $100 crude sooner than later. By the end of September, WTI reached an intraday high of $95.03, and it felt as if $100 crude was only days away. As we write on Nov. 10, WTI was as low as $75.31, and just a couple of days ago fell to $74.61.

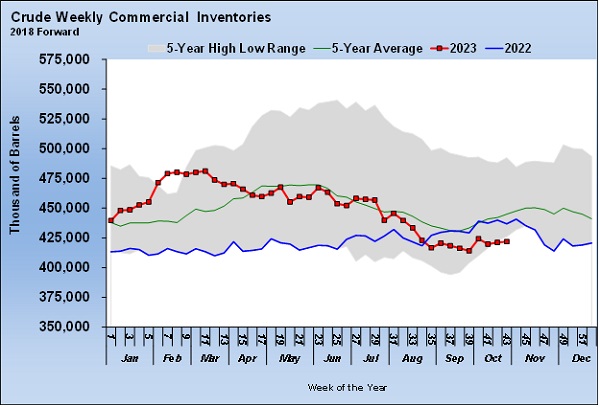

With propane fundamentals not supportive of propane’s prices, a bullish pricing case for propane generally depended on higher crude prices. If we just look at the U.S. crude inventory, one would think the bullish case for crude would still be in play. |

|

Currently, U.S. crude inventories are setting a five-year low for this time of year.

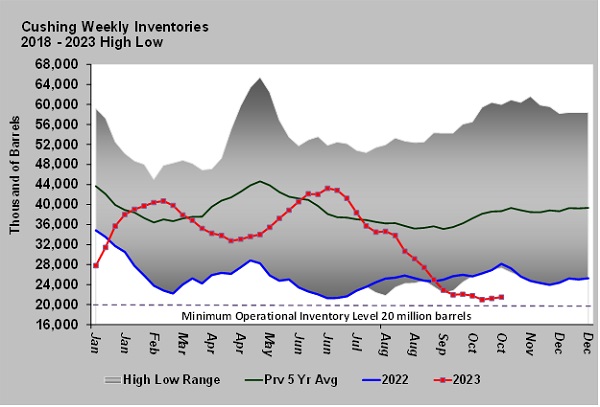

Critically, crude inventories at the U.S. trading hub at Cushing, Oklahoma, are hovering just above their minimum operational inventory level. Inventory levels at Cushing have an oversized impact on the market because of its significance in trading as well as supply distribution.

Yet, WTI crude is down 21 percent from its September high. Consequently, at a time when propane prices are normally rising at the beginning of the heating season, they have been falling. Propane has lagged the fall in WTI, having seen a 14 percent decline in value over that time. Nonetheless, the fall in crude has been enough to put propane prices into a counter-seasonal pricing trend. |

|

Crude has remained in its downtrend despite the war between Hamas and Israel starting in the middle of it. That war offers some risk to crude supply from the Middle East. Though prices initially rebounded when the war started, concerns about the war spreading in a way that would disrupt crude supplies have faded. |

|

As bullish support for crude prices has faded, there have been numerous bearish drivers stepping in to fill the void. During this downtrend, the value of the U.S. dollar has improved relative to competing currencies. In July, the dollar index stood at 99.842. By Oct. 3, it had reached 107. The rise generally came on the expectation the Federal Reserve would resume interest rate hikes. The index has fallen in recent days because the Fed did not raise rates, but still stands at 105.910. The strong dollar makes crude more expensive for those using other currencies, thus hurting demand. |

|

|

Economic data has raised concerns about crude demand. Economic activity in China, Europe and the U.S. has slowed. Manufacturing activity in those countries has fallen into contraction. Because of the weaker economic conditions, the U.S. Energy Information Administration (EIA) just lowered its global growth in crude demand for this year by 300,000 barrels per day (bpd) to 1.4 million bpd. Keep reading... |

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

RELATED

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |