|

|

|

THIS WEEK'S TOPIC: PROPANE EXPORTS |

|

|

|

Propane exports key to winter pricing |

|

Propane exports are going to be key to how this winter plays out from a pricing standpoint. That may sound like an odd statement given that weather and heating demand would logically be the key drivers this time of year.

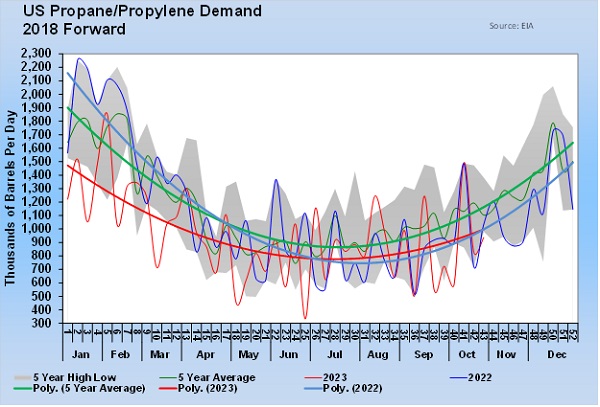

Over the past five years, propane demand has averaged 1.452 million barrels per day (bpd) from the first week of November through March. This past winter, demand during the same period ran 1.382 million bpd. |

|

As Chart 1 shows, demand was very weak in the second half of last winter. In July, demand moved above the previous year but is now back on the previous year’s trend line.

In recent Trader’s Corners, we have expressed concern that U.S. domestic demand will be weak again this winter. We point to weak crop drying demand, forecasts for El Nino conditions and a stressed U.S. consumer that is likely to be motivated to conserve as potential contributors to weak domestic demand.

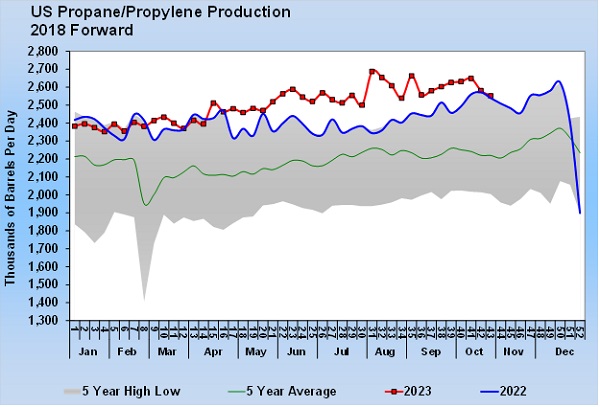

Meanwhile, U.S. propane production is near record highs. |

|

So far this year, propane production has averaged 95,000 bpd more than last year. Around the end of July, new fractionation capacity was brought online with output reaching a record 2.687 million bpd. Whether we look at that number or the average production for this year of 2.504 million bpd, propane supply easily outstrips potential domestic demand for this winter. |

|

At this point in our analysis, we are willing to use the five-year average winter demand of 1.452 million bpd rather than last year’s 1.382 million bpd, even though we have a bias that last year may turn out to be a more accurate reflection of this year’s demand. On the other hand, using this year’s average production is likely not to be reflective of what production will be through the winter. We believe production will average somewhere closer to 2.6 million bpd this winter. In addition to domestic production, the U.S. is likely to average about 160,000 bpd in propane imports for a total supply of 2.76 million bpd. |

|

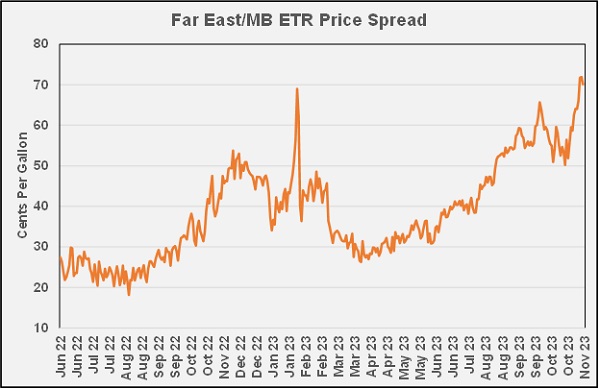

Using 2.76 million bpd for propane supply and 1.452 million bpd for domestic propane demand, propane exports must exceed an average of 1.308 million bpd to cause a draw on inventories. So far this year, propane exports have averaged 1.586 million bpd, up 265,000 bpd more than last year. Many analysts are expecting this export number to continue to rise because of new demand, especially from China. Keep reading... |

|

|

|

|

RELATED

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |