|

|

|

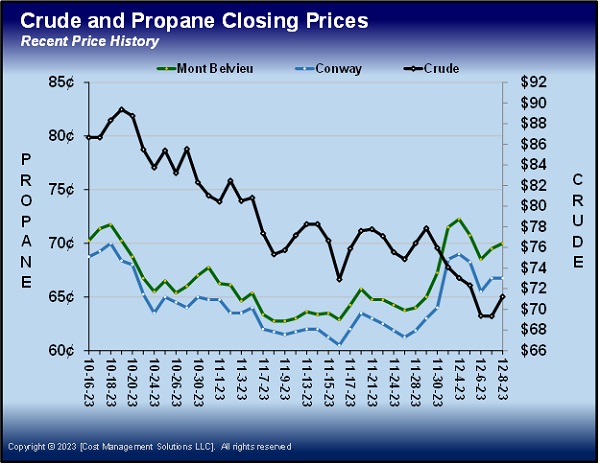

THIS WEEK'S TOPIC: PROPANE PRICES |

|

|

|

Speculative propane trading suggests prices could rise |

|

The Commodity Futures Trading Commission (CFTC) provides a report each Friday afternoon that shows traders’ positions in various commodities, including propane. We follow data on five commodities for our regular subscribers and clients: crude, gasoline, heating oil, Mont Belvieu propane and Conway propane. Since the CFTC report comes out late on Friday, we include the data in our Monday Propane Price Insider report.

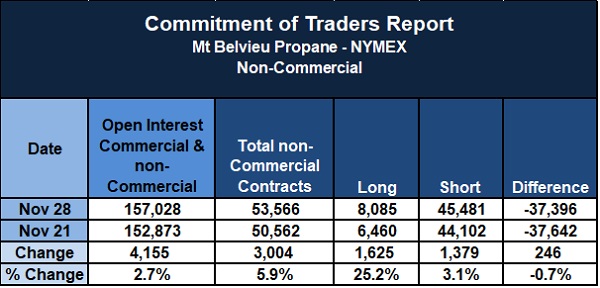

We use Chart 1 in that report to provide data for Mont Belvieu propane. This chart shows the weekly change from Nov. 21 to Nov. 28. |

|

Let’s walk through the different columns and discuss what the chart tells us. The first column shows the total number of Mont Belvieu propane contracts by both commercial and non-commercial entities. A contract is 1,000 barrels or 42,000 gallons.

For the week above, 4,155 more contracts were added for a 2.7 percent gain. There were 157,028 contracts in place on Nov. 28. That is a relatively small number of contracts. Gasoline and heating oil have more than 300,000 contracts in play, and crude has more than 1.5 million contracts. Conway propane only had 27,353 contracts in play. The small number of contracts means that propane is rather illiquid compared to other commodities. Liquidity comes from a lot of entities participating in the trade of a commodity. |

|

A lack of liquidity can cause the spread between buyers and sellers to increase, which is a negative for trading. Buyers bid, and sellers offer. The difference between bids and offers is called the bid/offer spread. Because crude is highly liquid, its bid/offer spread is pennies on the barrel. On the other hand, propane is illiquid, and the bid/offer spread is usually around 2 cents on the gallon. |

|

If a trader bought propane at the offer and sold it at the bid a minute later, he would almost certainly lose 2 cents on the trade. The downside is obvious. A trader in the propane market is going to have to see about a 2-cent movement in the market in his favor just to break even. Without speculators in the market, the bid/offer spread could be even wider.

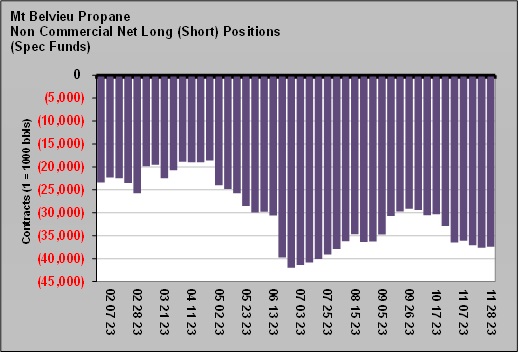

Commercial entities are those that participate in the propane business in some way. If a propane producer held a position, it would be included on the commercial side. The next column shows the contracts for non-commercial entities. Holders of these contracts are not in the propane industry. They just trade the paper in hopes of making a profit. We focus on the speculation positions because speculators only make money by correctly anticipating price direction. |

|

These non-commercial players are likely investment banks and other large financial institutions that have the resources to analyze a market to decide whether to be short or long on a commodity. Seeing where these players place their bets can tell propane retailers a lot about the perception of their commodity by the larger investment community. These folks are not always right, but it is insightful to know how they play the commodity we deal in. Keep reading... |

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

RECENT HEADLINES

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |