|

|

|

THIS WEEK'S TOPIC: PROPANE MARKET |

|

|

|

Propane market reacts as feared |

|

This Trader’s Corner (TC) is a follow-up to the one we wrote on Jan. 5 and released on Jan. 8. In that TC, we expressed concern that propane was undervalued, especially in Conway, given the recent downward inventory adjustment. We feared that the incoming weather was going to jolt the market into realizing the undervalued nature of propane, resulting in a significant bump in prices. We ended last week’s TC with the following statement:

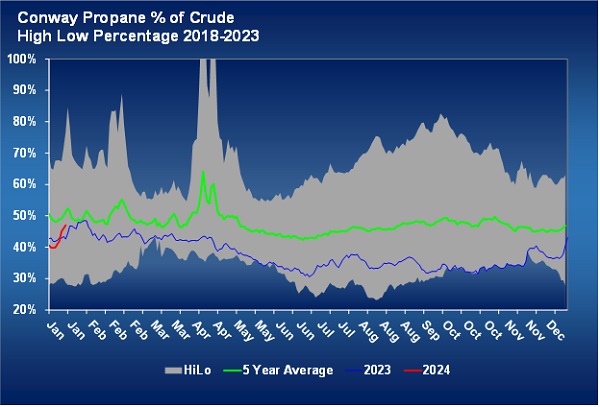

“If crude stays at $74 per barrel, and Conway gets revalued to 47 percent of WTI, it would be a 12-cent gain in Conway’s price. Given the situation, we think short-term price protections for propane supplies valued relative to Conway are appropriate for January. That can be done by filling tanks early, doing a pre-buy or using a forward/swap to cover short-term needs. To us, there is an increased upside price risk that is worth managing in some way.

“Further, we don’t think the risk is necessarily confined to the Midwest. If traders feel Conway needs to be revalued, that likely will carry over to Mont Belvieu as well.” |

|

You can visit last week’s article if you would like to see our arguments for making that statement.

When we wrote that TC on the evening of Jan. 5, Mont Belvieu propane had closed that day at 70.875 cents, 40 percent of the value of WTI crude. Conway had closed that day at 70 cents, also 40 percent of WTI. On the morning of Jan. 12, Mont Belvieu ETR propane was trading at 82.75 cents, 47 percent of WTI, and Conway was trading at 82.25 cents, 47 percent of WTI. WTI crude has traded between a low of $72.72 and a high of $75.25 per barrel (by midday Jan. 12). |

|

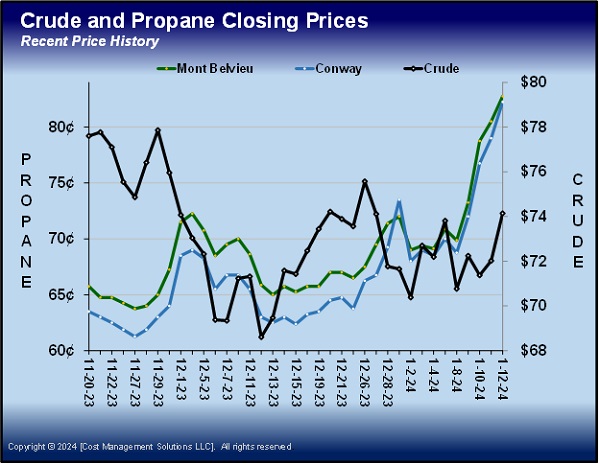

Chart 1 shows the recent closing prices for propane and crude. Propane has a tremendous amount of upward momentum. It has had some help from rising crude, but propane has easily outpaced crude to the upside. Thus, propane’s value relative to crude has increased. |

|

Chart 2 plots Conway propane’s value relative to WTI on a simple percentage basis. You can see that Conway has now gone a long way toward correcting its undervaluation relative to crude and is approaching the five-year average for this time of year. The chart for Mont Belvieu ETR propane shows an almost exact change. |

|

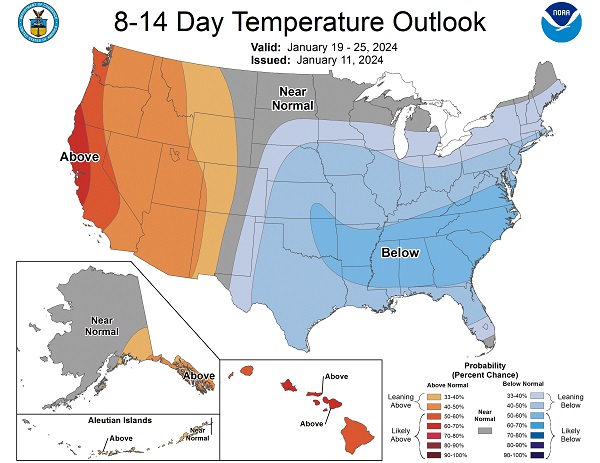

There is no reason for propane not to continue to improve against crude, likely reaching 50 percent of crude’s value. Crude also can go higher because of an escalation in the geopolitical tensions in the Middle East that occurred overnight. Keep reading... |

|

|

|

|

RECENT HEADLINES

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |