|

|

|

THIS WEEK'S TOPIC: BUYING DECISIONS |

|

|

|

Propane market reaches normalization |

|

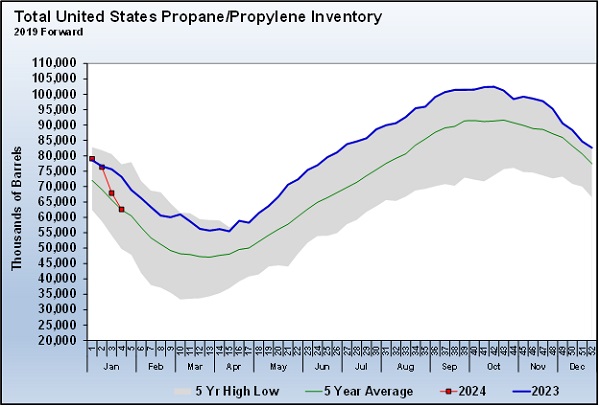

In last week’s Trader’s Corner, we discussed the record-setting propane inventory draw for the week ending Jan. 19. A severe winter storm not only caused more demand but also disrupted supplies. Things had not returned to normal by Jan. 19, and we feared another above-average draw when data was collected on Jan. 26 for the U.S. Energy Information Administration’s Weekly Petroleum Status Report released on Jan. 31. That was the case. |

|

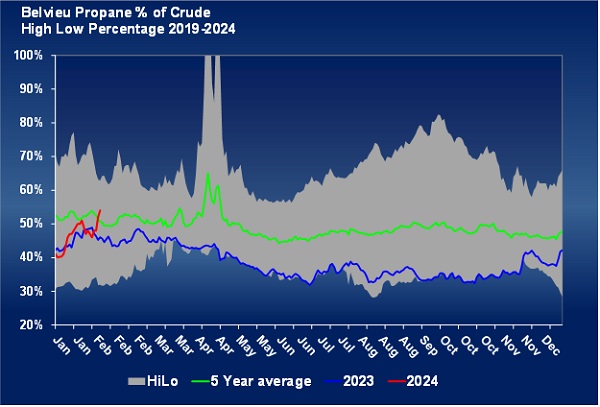

Mont Belvieu ETR propane was up 20 cents, or 28.73 percent, and Conway 18.5 cents, or 26.91 percent, in January. Both have continued higher in February with the inventory draws in support.

|

|

When propane prices increase as much as they did in January, it feels like the market is getting away from a buyer. But are prices getting away from buyers, or does it just feel that way? The fact is that propane markets have remained tame through this inventory adjustment process. |

|

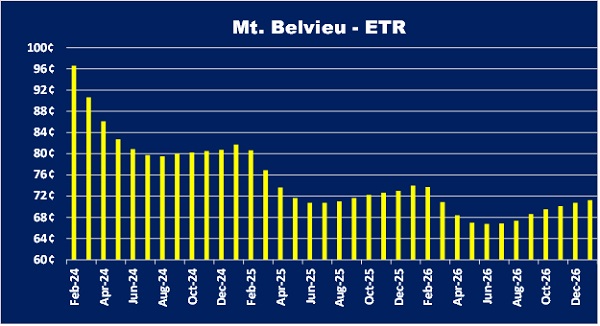

Chart 2 is the forward price curve for Mont Belvieu ETR propane. A forward price curve is not a prediction of where prices will be in the future. This is a three-year price curve, and it reflects where the market currently values propane in each of the next 36 months.

Note how the market prices propane needed soon a lot higher than it values propane needed in the future. This is known as a backwardated pricing environment and is typical in a normally supplied market. In the case of the current pricing environment, the front months (nearest to the current month) are strongly backwardated, which suggests short-term supply tightness. The sharp backwardation means the market is pricing propane as if the current supply tightness will resolve quickly. |

|

As propane buyers, we would like to avoid being buyers of February propane if we can. This is a case where having a prebuy or a forward (financial) position would be helpful. But what about prices further down the curve? Has the market gotten away from the buyer? Keep reading... |

|

|

|

|

RECENT HEADLINES

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |