|

|

|

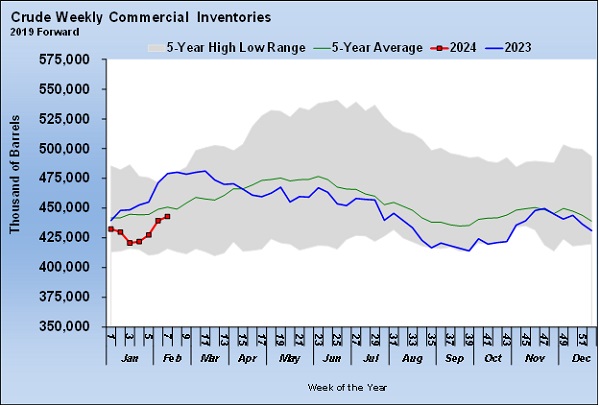

THIS WEEK'S TOPIC: CRUDE INVENTORY |

|

|

|

Tighter refined fuels inventories could be ahead |

|

There could be more upward pressure than usual on U.S. refined fuels prices this summer if the fighting in Ukraine and Gaza continues. In this Trader’s Corner, we look at the state of U.S. crude and refined fuels inventories as the summer driving season approaches and why those inventories could tighten this summer. |

|

U.S. crude inventories are recovering from the January winter storm and are once again near the five-year average for this point in the year. A key reason for the rapid recovery in inventory has been very low refinery throughput.

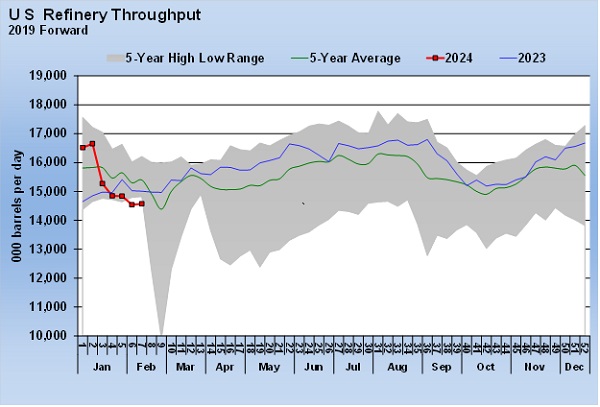

Refinery throughput dropped sharply in January as frigid temperatures from the winter storm impacted operations. Spring is the typical maintenance season for refiners as they try to optimize operations heading into the high-demand summer period for refined fuels. After the winter storm negatively impacted operations, many decided to move up maintenance work rather than going through restarting and shutdown processes again. |

|

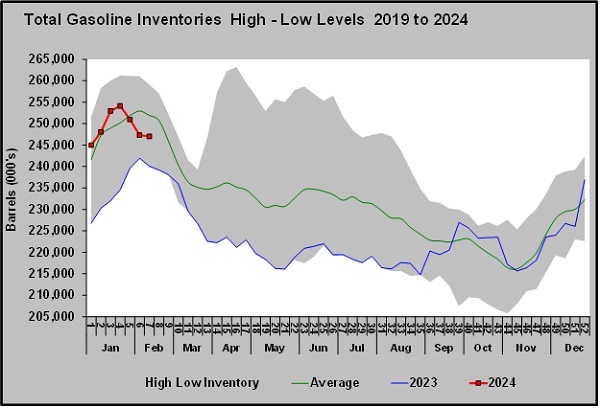

While that has been good for crude inventories, it has been a negative for refined fuels. Lower output by the refineries has resulted in more calls on refined fuel inventories.

U.S. gasoline inventory had jumped above average as the winter storm slowed demand. But the rise was only temporary without normal refinery throughput to keep the pressure off inventories. |

|

U.S. distillate inventories were already below normal, and the low refinery throughput has pushed them down to the low levels experienced last year and not far above a five-year low. Globally, distillate inventories have been tight because of increased use for power generation. As Europe banned natural gas imports from Russia in response to Russia's invasion of Ukraine, diesel was used to offset the loss of that fuel for electrical generation. |

|

The good news is that refiners will be coming out of maintenance sooner than normal, so recovery in refined fuels inventories should occur before the heaviest domestic demand hits. Unfortunately, building inventories back to normal, or even above normal, may not be enough to remove more upward price pressure than usual this summer. The wars in Ukraine and Gaza may cause increased demand for U.S. refined fuels globally. If more gets exported, domestic prices will rise. Keep reading... |

|

|

|

|

RECENT HEADLINES

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |