|

|

|

THIS WEEK'S TOPIC: PROPANE SUPPLY |

|

|

|

US is oversupplied with propane |

|

The U.S. has far more propane production than it does domestic demand. We all know this, but in this Trader’s Corner, we look at key components of supply and demand to identify just how significant the imbalance between supply and demand is in the U.S.

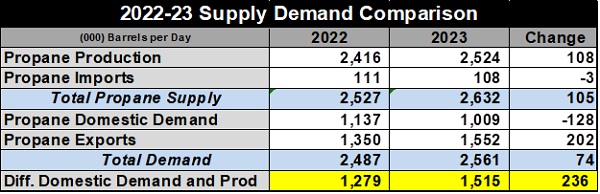

The table below compares supply and demand changes between 2022 and 2023. Supply consists of production and imports. U.S. production increased, continuing an uptrend. Increased propane production is driven by increases in U.S. natural gas and crude production. |

|

Propane imports have been trending lower. Essentially, all U.S. propane imports come from Canada. Canada has increased its capability to export propane via rail to Mexico and via water to Asia. The U.S. is the export destination of last resort, with most occurring in areas where there are logistical advantages near the border.

Demand consists of U.S. domestic demand and exports. On the domestic side, demand comes from propane retailers and petrochemical companies. Petrochemicals are around 25 percent to 30 percent of demand, leaving the balance on the retail side. |

|

Petrochemical demand varies based mostly on economic conditions and on how propane’s price compares to ethane and other feedstocks. Ethane is significantly cheaper than propane, so it is by far the preferred feedstock, but the demand for propane remains because its properties are needed for certain end products the petrochemicals need to make. Retail demand varies primarily on heating demand, which is highly dependent on weather. |

|

A combination of weak economic conditions, cheap ethane and a series of weak winters has domestic demand trending lower in recent years. U.S. domestic demand fell by 128,000 barrels per day (bpd) between 2022 and 2023. Meanwhile, higher crude and natural gas production and more fractionation capacity increased U.S. propane production by 108,000 bpd.

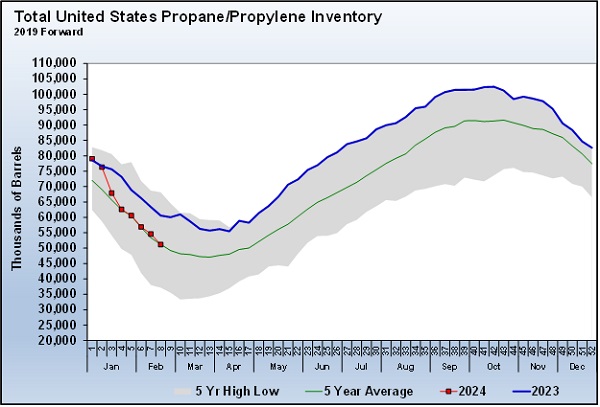

With domestic supply and demand going in opposite directions, the difference between propane supply and its demand grew 236,000 bpd to 1.515 million bpd. This excess supply is either exported or stored. Even though propane exports grew by 202,000 bpd and imports fell by 3,000 bpd, it was not enough to offset the combination of increasing production and decreasing domestic demand, resulting in inventory growth that put downward pressure on pricing throughout 2023. |

|

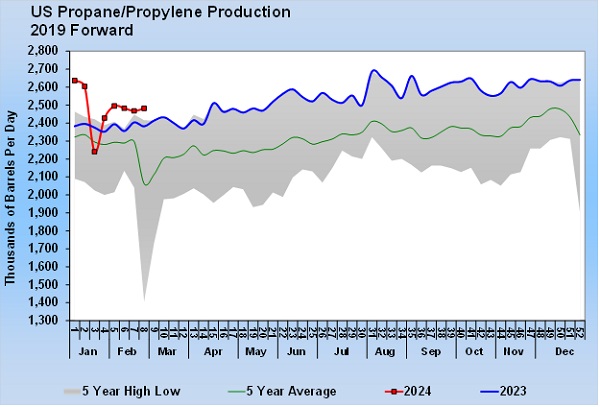

In 2024, the overhang on propane inventories has been eliminated, causing inventories to return to about the five-year average. Note that the decline began with the winter storm in January. Increased demand during that time was a factor, but the larger factor was the disruption to U.S. propane production. Keep reading... |

|

|

|

|

RECENT HEADLINES

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |