|

|

|

THIS WEEK'S TOPIC: PROPANE PRICES |

|

|

|

Is there an opportunity in the propane market? |

|

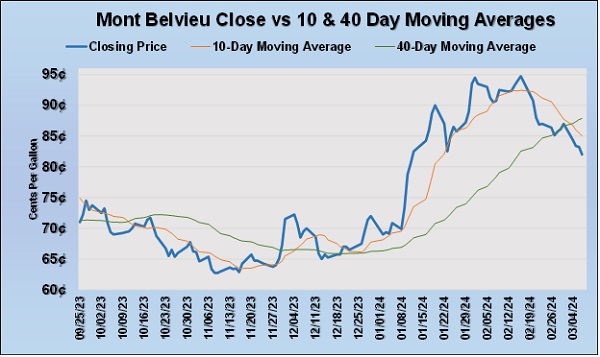

Propane prices have been declining since the middle of February. The market feels bearish – and with good reason.

The end of winter is in sight, and the temperature outlooks for the remainder of this month look like they will be higher than normal. Heating degree-days so far this year are 12 percent below normal and 3 percent below last year, continuing a concerning trend. |

|

There hasn’t been much interest in the market to fix future supply costs. In fact, most of the effort has been to close positions for the remainder of this winter, into the summer, and even next winter. With the market vibe bearish, is it possible an opportunity is being overlooked?

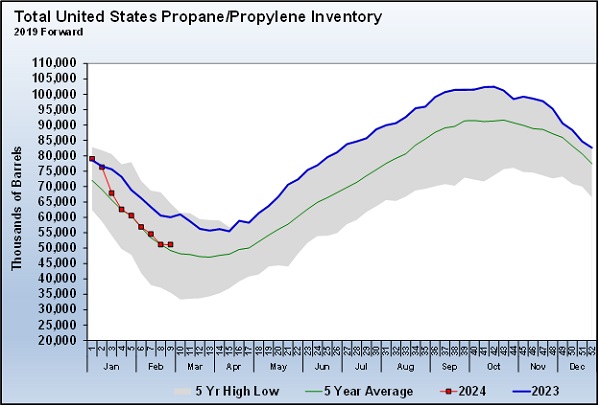

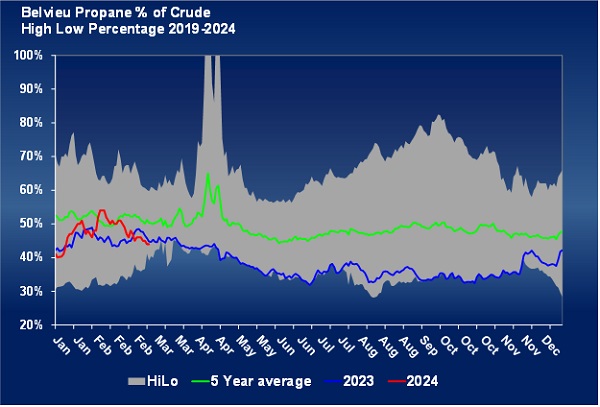

We can’t know what propane prices will be for this coming winter. Our Trader’s Corner last week focused on the oversupply of propane in the U.S. As we pointed out, U.S. propane production is running about 1.5 million barrels per day (bpd) more than domestic demand. Without robust exports, U.S. propane would be essentially free. We also pointed out that the highest demand day last year stayed well below the lowest propane production day. Should global demand for U.S. propane slow, then more downward pressure on prices could develop. |

|

We don’t know for sure if global demand for propane will decrease or increase. Most analysts seem to believe foreign demand for U.S. propane is going to remain strong. There is a lot of new demand for propane being created with the construction of more propane dehydrogenation units (PDH). PDH plants take fuel-grade propane and turn it into propylene for the petrochemical industry. Over the last few years, China alone has been adding around six new PDH plants per year. |

|

Last year, China increased LPG imports by 21 percent – from 26.6 million metric tons to 32.21 million metric tons. That is an increase of 5.61 million metric tons. There are 12.7 barrels of propane in a metric ton, so that is an equivalent increase of 71.247 million barrels of propane. To put that in perspective, the U.S. currently has 51.177 million barrels of propane/propylene in storage. So just the LPG increase in demand from one country last year exceeded what the U.S. currently has in storage. Not all the increase was propane, but it was the bulk of it. |

|

The point is that U.S. propane prices are highly dependent on the health of the global economy, which makes projecting propane prices in the future much more difficult than years ago when we were a net importer of propane. Because propane demand for heating in the U.S. is becoming proportionally less of total demand, seasonal pricing patterns are less predictable. Keep reading... |

|

|

|

|

RECENT HEADLINES

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |