|

|

|

FREE CMS WEBINAR | MARCH 27 @ 10AM CT Join Trader's Corner partner CMS for a free 30-minute Virtual Hedging Seminar. Buy smarter, manage costs and protect from rising prices! |

|

THIS WEEK'S TOPIC: PROPANE INVENTORY |

|

|

|

Breaking down the new propane inventory number |

|

Over the past three weeks, the Energy Information Administration (EIA) has provided its new propane inventory number. In the Trader’s Corner we wrote Nov. 17, 2023, we discussed the significance of the number after the EIA announced it would provide this new data point. Now that the number is out, it is worth rehashing its significance.

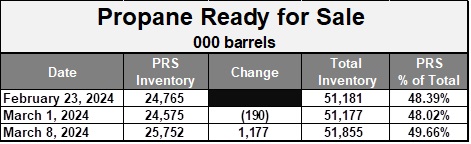

The new data point is called “Propane ready for sale.” The table provides the small sample size for the number. |

|

For the week ending March 8, propane ready for sale (PRS) inventory stood at 25.752 million barrels. The headline total inventory number reported by the EIA was 51.855 million barrels. We now know that propane ready for sale accounts for just under 50 percent of the headline inventory number. That is good information, and we are glad we now have it.

The headline inventory number contains some propylene, propane upstream of fractionators in the storage caverns at Mont Belvieu and Conway, and fungible propane downstream of the fractionator. The PRS number is just the fungible propane already fractionated and sitting in product-specific caverns ready for shipment to demand areas via trucks, trains and pipelines. |

|

As we have said before, it will be years before the new number has enough data points covering varying conditions for it to have a lot of relevance. For now, it will be hard for changes in that number to drive propane prices. We think the focus will remain on the total inventory number for a few more years. But we think that once that number has some history it will become the default number that the retail propane industry will focus on. We can see the day when most of the propane inventory charts and graphs we provide in our daily Propane Price Insider (PPI) reports will focus on that number. But even now it is nice to know the percentage of the total inventory that is ready for sale. |

|

One of the most important aspects of the propane industry to understand is that propane supply is rather inelastic. What does that mean? It means that propane supply or production does not respond much to propane demand. For most commodities, production reacts quickly to demand. Refiners quickly reduce throughput if gasoline and distillate demand drops. Natural gas and crude producers adjust drilling activity based on the demand for those commodities. Farmers adjust acreage planted and make crop selections based on the price of a cash crop, which reflects demand. So why doesn’t propane respond to a decline in demand? |

|

Propane is a small part of overall hydrocarbon production. Producers drill wells into hydrocarbon zones, and those wells yield an array of hydrocarbons. Propane is way down the list in terms of consideration on whether a hydrocarbon well is drilled or not. So even though propane inventories may be high and demand low, propane supply will not respond because the combined value and demand for all hydrocarbons is driving the decision to drill or not. Thus, the inelasticity on the propane supply side. Keep reading... |

|

|

|

|

RECENT HEADLINES

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |