|

|

|

FREE WEBINAR | WED May 29th @ 10AM CT Join Trader's Corner partner CMS for a free 30-minute Virtual Hedging Seminar. Buy smarter, manage costs and protect from rising prices! |

|

THIS WEEK'S TOPIC: NATURAL GAS IMPACTS |

|

|

|

Natural gas production slowing |

|

U.S. natural gas prices have recently fallen to a 3.5-year low, causing some natural gas producers to shut in production or to delay completing newly drilled wells. The collapse in natural gas prices to under $2 per MMBtu has natural gas valued at the equivalent of 17 cents per gallon of propane. That is up from around 11 cents per Btu equivalent of propane a few weeks ago. |

|

Natural gas prices have dropped about 23 percent since the first of the year. On an inflation-adjusted basis, natural gas prices are at 30-year lows. Some producers are responding. Chesapeake Energy and EQT have curtailed production, which has helped push natural gas prices off their lows. The cutbacks caused natural gas output to drop nearly 7 percent last month.

March natural gas production was around 98 billion cu. ft. per day (Bcf/d) from just over 104 Bcf/d in February. The production cuts caused natural gas prices to rise from $1.511 per MMBtu to $1.8350 per MMBtu. |

|

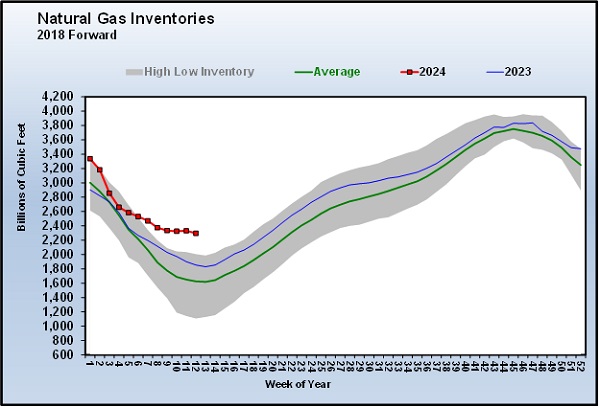

So far, the production cuts have done little to impact a significant overhang in natural gas inventories. We did see a slight decrease in inventory last week, but overall they are setting significantly higher five-year highs for this time of year. In fact, they are about 41 percent higher than normal for this time of year. Producers have their work cut out for them to get inventories back in line. Obviously, the very weak winter demand was a huge factor in inventories surging. |

|

If mild weather hasn’t been enough, the nation’s largest liquefied natural gas (LNG) export facility has reduced capacity due to maintenance work. In addition, more renewables used for electricity generation could cut into the demand for natural gas for that purpose.

The relationship between natural gas and propane is a two-edged sword. Natural gas is a competing energy source with propane. But, more importantly, propane supply is directly related to natural gas production. Natural gas has become so plentiful in the U.S. that propane has not been a competitive Btu with it for some time. Even when natural gas prices were much higher, propane struggled to compete. Part of the reason is that if natural gas supplies got too low, propane would be rejected at the natural gas processing plants. This would tighten up propane supply and push propane’s price higher. |

|

|

Normally, at natural gas processing plants, as much of the propane as possible is removed from the methane that is sold to the natural gas companies. But if natural gas supplies get tight and prices go too high, some of the propane will be left with the methane. Keep reading... |

|

|

|

|

RECENT HEADLINES

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |