|

|

|

FREE WEBINAR | WED MAY 29th @ 10AM CT Join Trader's Corner partner CMS for a free 30-minute Virtual Hedging Seminar. Buy smarter, manage costs and protect from rising prices! |

|

THIS WEEK'S TOPIC: WINTER PREP |

|

|

|

Looking forward to next winter and beyond |

|

Just outside our office door, birds are chirping, flowers are blooming and trees are leafing out. Spring is upon us. For the week ending April 6, there were 105 heating-degree days (HDDs) on a nationwide population-weighted average, but, for the most part, we can close the books on the 2023-24 winter.

It was not a particularly good winter if your livelihood depends on selling Btus. Since July 1, there have been 3,612 HDDs. That is 479 HDDs, or 12 percent, below normal. The tally is running 192 HDDs, 5 percent, below last year. |

|

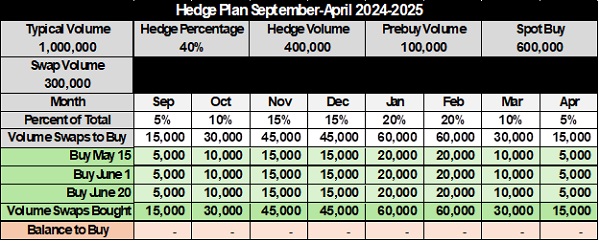

But hope springs eternal, and propane retailers will now turn their attention to preparing their supply portfolios for next winter and beyond. With the recent pullback in prices, values look better for the winter of 2024-25 but still a little pricey. Pricing for the further-out winters looks better. Remember, you can use forwards/swaps to fix supply costs for up to three years out. Right now, a retailer could fix prices for the next three winters. |

|

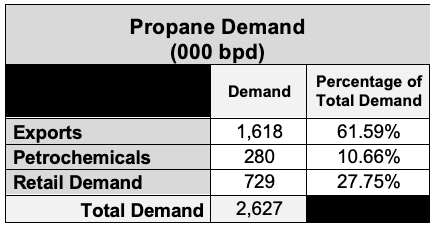

As we have recently discussed, with propane exports now constituting 62 percent of total U.S. demand, the seasonal patterns on pricing are no longer as distinct nor as reliable as they once were when retail demand was the bulk of overall demand. |

|

Nevertheless, between now and the end of June, we should expect some of the best propane values based on history. Over the past five years, front-month propane has averaged around 74 cents during May and June. April has averaged around 78 cents, so the odds favor putting our plans together over the next couple of weeks and begin executing them in the upcoming couple of months. |

|

|

In case you are wondering which month has averaged the lowest price over the past five years, it has been December at around 71 cents. December has also averaged the lowest over the past 10 years, so it is a more consistent pattern than you might think. In general, there tends to be higher prices during the fall, during the hype and buildup to winter, and in the final three months of winter when supplies can get a little more stretched if there is good heating demand. Keep reading... |

|

|

|

|

RECENT HEADLINES

|

|

|

|

|

|

|

PREVIOUS TOPICS

|

|

|

|

|

|

|

|

|

|

Cost Management Solutions LLC (CMS) is a firm dedicated to the unbiased analysis of the energy markets for the propane industry. Mark Rachal, Director of Research and Publications at CMS, regularly provides insightful looks into various facets of the marketplace. |

|

|

|

|

FROM THE MAGAZINE

|

|

|

|

|

|

|

|

You are currently subscribed to LP Gas as @{Email Name}@ |